WeMasterTrade: Sustainable Prop Trading Framework

As financial markets grow increasingly sophisticated, the demands on professional traders have undergone substantial transformation. Achievement today transcends mere occasional gains or fleeting accomplishments, centering instead on the capacity to deliver steady results, handle risks proficiently, and respond adeptly to shifting market dynamics across extended periods.

A Platform Built for Enduring Trading Success

WeMasterTrade emerged precisely to champion this contemporary perspective on expert trading. Eschewing promises of instant triumphs or overly simplistic paths to riches, the platform prioritizes constructing a methodical, open prop trading system that fosters enduring trader advancement.

Through synchronizing capital provision with rigorous performance standards, WeMasterTrade cultivates an ecosystem optimized for prolonged trader evolution and career sophistication.

Core Focus on Trading Discipline and Responsibility

Central to WeMasterTrade’s architecture is an unwavering commitment to discipline alongside accountability. The entire system is engineered to promote prudent trading practices, grounded anticipations, and reliable implementation of strategies.

Every aspect of trading parameters and assessment metrics is meticulously outlined upfront, enabling participants to concentrate their efforts on refining their methodologies free from ambiguity. This methodology echoes the rigorous protocols of institutional trading desks, where enduring track records and stringent risk oversight eclipse transient market swings.

WeMasterTrade holds the conviction that discipline serves not as a hindrance, but rather as the bedrock upon which lasting triumphs are erected.

Adaptive Funding Pathways Matched to Trader Proficiency

Acknowledging the diverse trajectories along which traders progress, WeMasterTrade delivers versatile funding routes customized to match varying degrees of expertise and self-assurance.

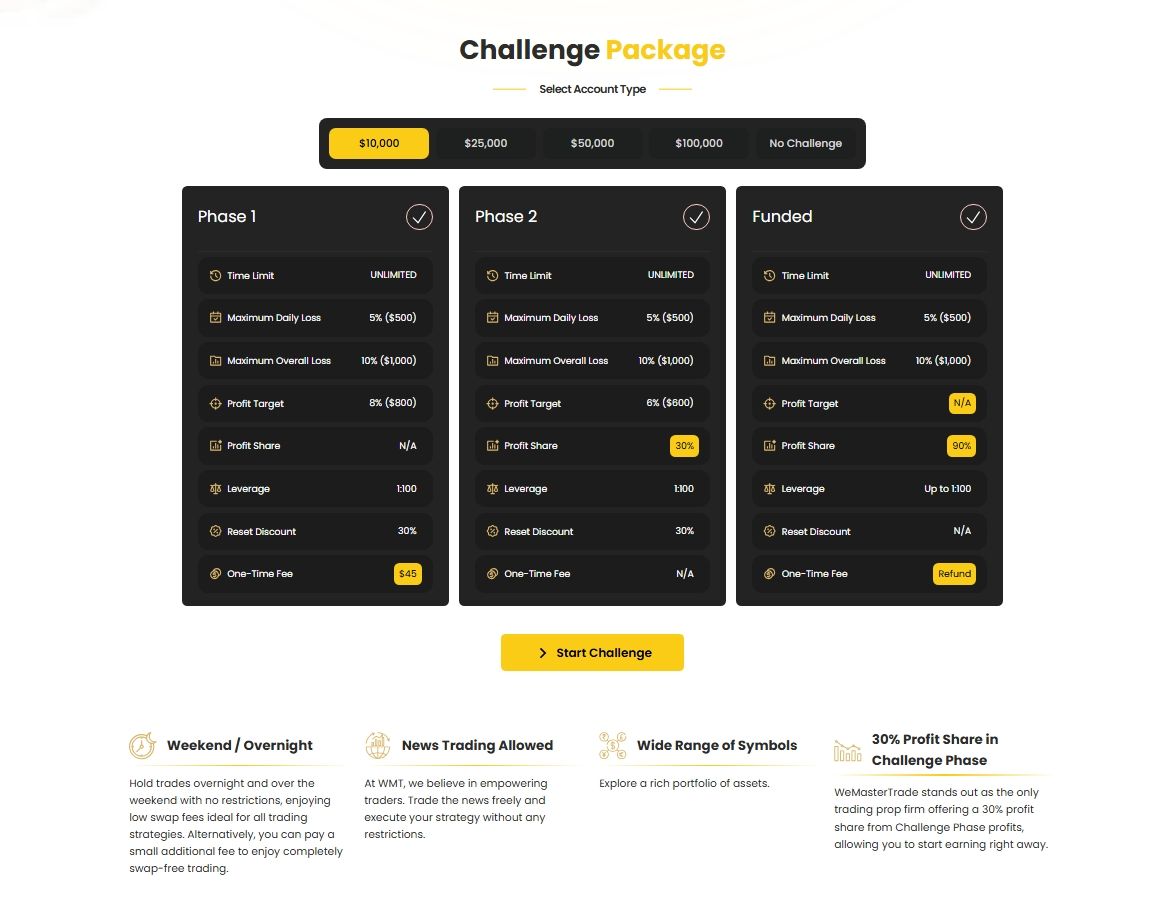

Challenge Accounts: Structured Pathway for Skill Enhancement

The Challenge account stands as a meticulously crafted option for those traders aiming to polish or confirm the viability of their approaches through a regulated, forthright evaluation mechanism.

This framework underscores several pivotal elements:

- Reliable performance sustained over numerous trading periods

- Sound, actionable risk mitigation strategies

- Mastery over emotional responses amid authentic market pressures

- Precise, measurable targets for evaluating outcomes

Via this organized methodology, participants are guided to cultivate practices that underpin ongoing reliability, prioritizing depth over ephemeral achievements.

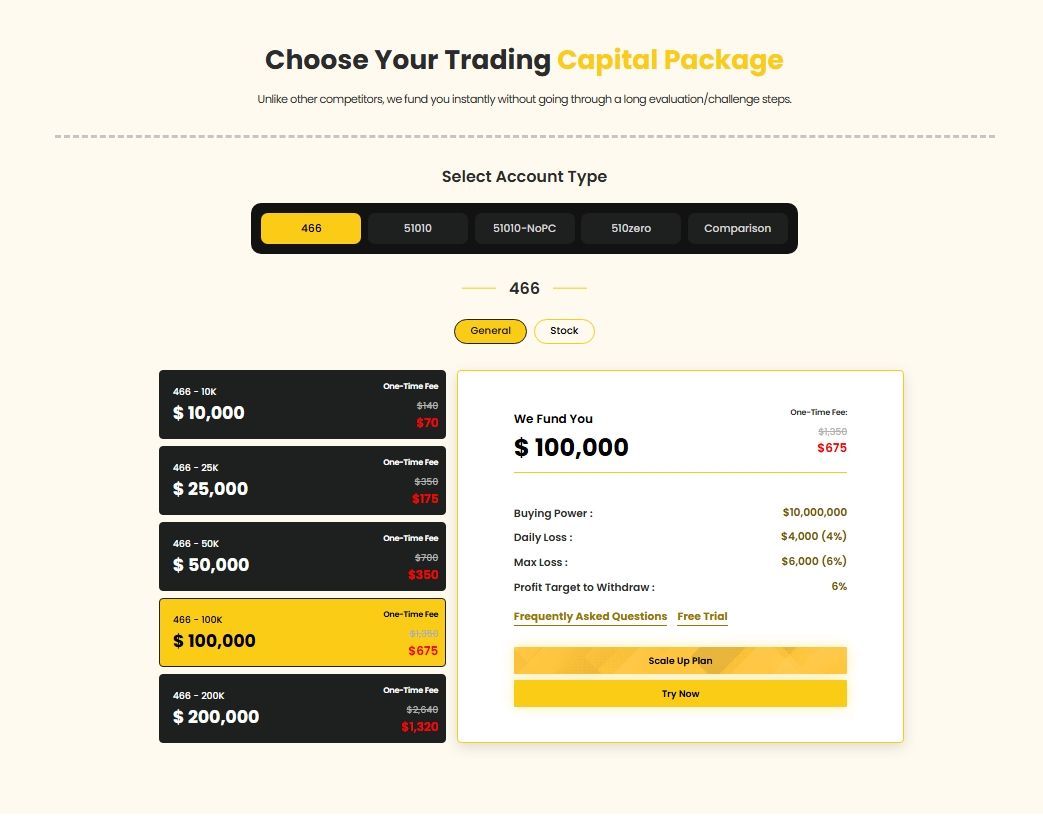

Instant Accounts: Direct Capital for Proven Experts

Tailored for individuals already equipped with robust technical prowess and adept risk oversight capabilities, the Instant account grants straightforward entry to allocated trading funds.

Distinguishing features encompass:

- Seamless commencement of trading activities

- Absence of initial vetting procedures

- Liberty in deploying preferred trading methodologies

- Opportunities for progressive capital expansion

- Advantageous arrangements for revenue distribution

This pathway caters specifically to those equipped to thrive immediately within a sophisticated trading milieu from the outset.

Advanced Technology for Equitable and Streamlined Operations

Reliable, transparent technological underpinnings form the cornerstone of elite trading endeavors. WeMasterTrade commits ongoing resources to technological enhancements, guaranteeing impartial order fulfillment and steadfast functionality.

Fundamental advantages of the infrastructure comprise:

- High-speed, minimal-delay order processing

- Optimal spreads and execution pricing

- Comprehensive documentation of guidelines and protocols

- No constraints on trading approaches

- Mechanisms for scaling based on demonstrated results

- Specialized assistance for operational matters

Collectively, these components forge a trading habitat that eliminates unnecessary obstacles, empowering traders to dedicate their attention to analytical judgments and precise risk stewardship.

Prioritizing Enduring Benefits Beyond Transient Gains

WeMasterTrade embraces a forward-looking stance toward nurturing trader capabilities. Diverging from hype-driven tactics or accelerated advancement schemes, it champions gradual refinement and dependable output.

Guiding principles include:

- Openness in all interactions

- Adaptability across funding options

- Steadfastness as the paramount indicator of achievement

Such tenets assure that support extends beyond initial successes to their preservation and enhancement longitudinally.

Nurturing Career Advancement Across All Levels

From nascent phases of skill-building to overseeing substantial capital deployments, WeMasterTrade furnishes a dynamic structure that advances in tandem with trader milestones.

By centering on organization, responsibility, and sustained congruence, WeMasterTrade establishes itself as a premier prop trading venue crafted for specialists who prize progressive development above momentary windfalls.