Vanguard Predicts Bond ETF to Outperform U.S. Stocks Long-Term

Recent analysis from Vanguard expresses strong optimism regarding bonds over the coming years, potentially surpassing the performance of U.S. growth stocks in the equity markets.

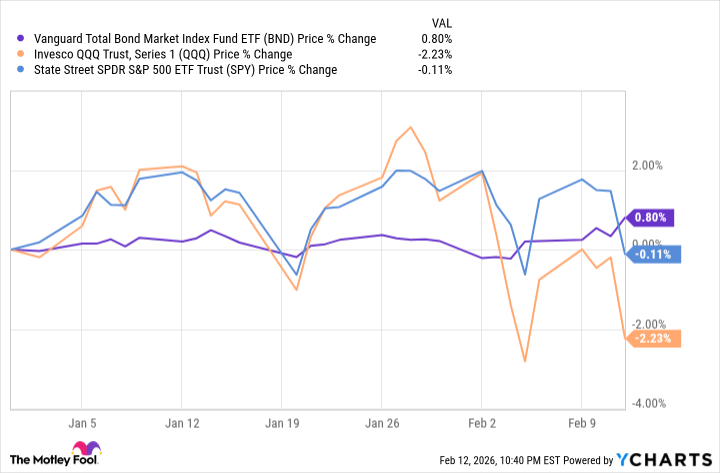

The American stock market has encountered a challenging beginning in 2026. Specifically, the S&P 500 index has experienced a slight decline of 0.1% since the start of the year, whereas the technology-focused Nasdaq-100 index has dropped by a more significant 2.2%. In contrast, one particular exchange-traded fund has demonstrated superior results, outperforming both of these major indices: the Vanguard Total Bond Market ETF, which has achieved a positive return of 0.8% year to date.

Typically, bonds do not surpass stocks in performance, especially over extended periods. Historical data from the Deutsche Bank Research Institute’s Long-Term Asset Return Study indicates that, over the last century, U.S. bonds have never exceeded the returns of U.S. stocks across any 25-year period examined.

However, amid concerns stemming from the latest sell-off in technology stocks, or if you are seeking to broaden your investment portfolio beyond a concentrated group of prominent artificial intelligence companies, or perhaps aiming to generate consistent income from your holdings, incorporating bonds into your strategy might prove to be a prudent decision.

Fresh insights from Vanguard have put forward an unexpected forecast that merits attention from investors. This analysis explores the rationale behind why allocating funds to bonds could represent a wise investment approach at this juncture.

Vanguard’s Analysis: Bonds Poised to Surpass Equities

In its 2026 economic and market outlook, Vanguard maintains a positive stance on bonds while adopting a more cautious perspective toward U.S. stocks. The firm’s projections estimate average annual returns ranging from 3.8% to 4.8% for U.S. bonds over the subsequent decade, compared to a narrower band of 4% to 5% for U.S. equities. Furthermore, Vanguard highlights that high-quality U.S. bonds offer the most attractive risk-return characteristics among publicly available investment options for the forthcoming five to ten years, with U.S. value stocks and equities from developed international markets trailing closely behind.

This outlook does not necessarily signal the collapse of the AI bubble. Vanguard acknowledges that technology stocks may sustain robust performance; nevertheless, it cautions that risks are intensifying due to prevailing market enthusiasm, and more appealing opportunities are materializing in other sectors, even for those with the most optimistic views on AI’s trajectory.

Regardless of individual opinions on the prospects of AI stocks, Vanguard’s projections serve as a vital reminder of the importance of diversification in investment portfolios. There are no assurances that the rapid expansion witnessed in the U.S. tech-dominated stock market over recent years will persist indefinitely. The present moment may present an opportune time to incorporate bonds into your holdings, tailored appropriately to your personal investment timeline and capacity for risk.

Strategies for Investing in Bonds Today

While Vanguard’s economic and market outlook does not endorse a particular bond fund, the Vanguard Total Bond Market ETF stands out as a fitting example of a vehicle for high-quality U.S. bonds. This ETF provides investors with exposure to a vast array of 11,444 investment-grade bonds spanning the entire U.S. dollar-denominated bond landscape.

With an impressively low expense ratio of just 0.03%, this fund ranks among the most cost-effective options available in the investment universe. Over the preceding three years, it has generated average annual returns of 3.6%. This makes it one of the simplest and most economical methods to gain immediate access to a widely diversified collection of both government and corporate bonds.

The steady income generated from bonds may lack the thrill associated with the exceptional gains from top-performing high-growth technology stocks in recent years. Nonetheless, for individuals whose primary objectives include producing reliable income and safeguarding principal against potential stock market declines, directing a portion of capital toward bonds constitutes a shrewd financial maneuver. Moreover, these dependable, albeit conventional, bonds could potentially deliver returns that exceed those of the Nasdaq-100 over the next several years.