UK Inflation Drops to 3.0% in January 2026

UK Inflation Declines in Early 2026

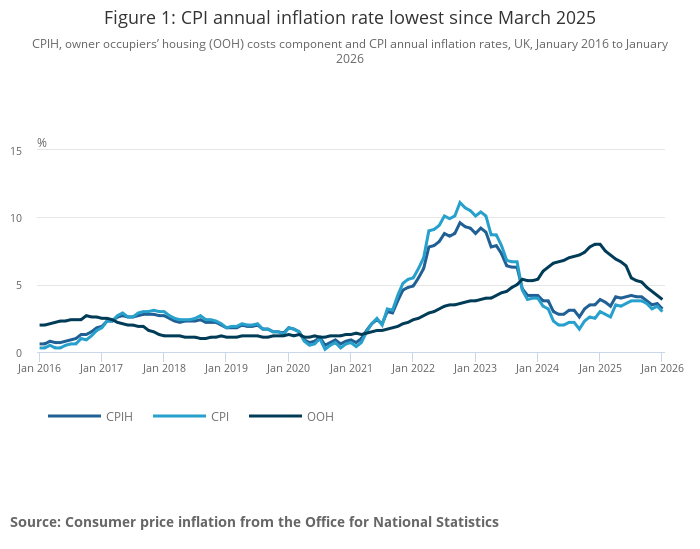

Data published on the morning of 18 February by the Office for National Statistics revealed that UK inflation decreased over the 12 months ending in January 2026, reversing a slight increase observed in December 2025.

The primary Consumer Prices Index inflation rate climbed by 3.0% in the year leading up to January, marking a reduction from the previous month’s 3.4% figure. This outcome was marginally higher than the 2.9% rise anticipated by economists at the Bank of England.

Although inflation experienced a temporary upswing in December, the overall trajectory for the UK’s inflation rate has been steadily declining in recent months. The January reading of 3.0% represents the lowest annual CPI inflation pace since March 2025, signaling continued moderation in price pressures.

Bank of England projections indicate that CPI inflation will hover around 3% throughout the initial quarter of 2026. However, the central bank anticipates a further drop to approximately 2.1% by April, bolstered significantly by the disinflationary policies enacted in the previous year’s Autumn Budget.

This recent easing of UK inflation in January is poised to bolster prospects for an interest rate reduction at the forthcoming gathering of the Bank of England’s Monetary Policy Committee.

Luke Bartholomew, deputy chief economist at asset manager Aberdeen, noted, “Services inflation came in somewhat stronger than anticipated, which is a factor the Bank considers closely. Yet, with yesterday’s labor market figures highlighting persistent employment challenges and a continued slowdown in wage increases, the majority of policymakers will probably disregard any temporary firmness in services inflation data.”

From December to January, the CPI experienced a monthly decline of 0.5 percentage points.

Factors Driving the January Decline in UK Inflation

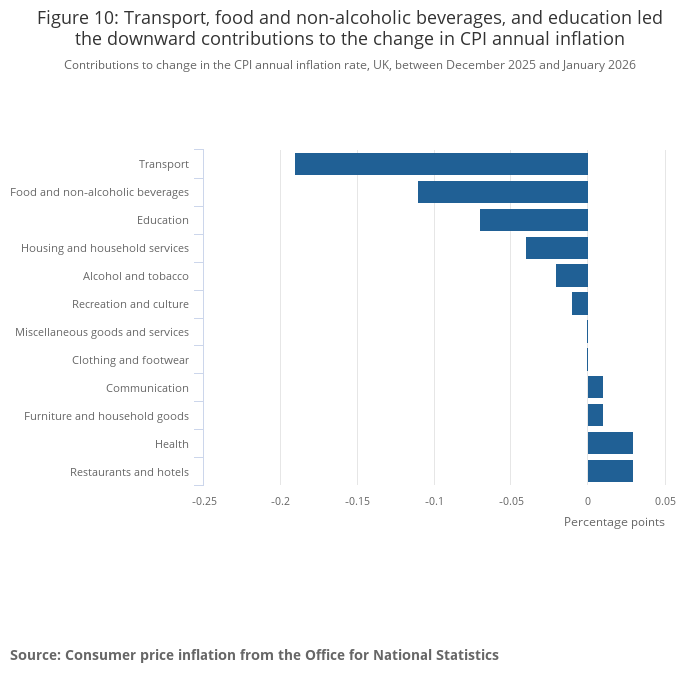

The most substantial downward pressures on annual inflation through January stemmed from sectors including transport, food and non-alcoholic beverages, as well as housing and household services.

Grant Fitzner, the chief economist at the Office for National Statistics, explained, “Inflation dropped sharply in January, reaching its lowest yearly level since March of the previous year, influenced in part by falling petrol prices.”

He added, “Airfares also exerted downward pressure this month, as prices retreated from the elevations seen in December. Additionally, reductions in food prices contributed to the broader deceleration in UK inflation during this timeframe.”

Conversely, upward momentum in price growth was primarily fueled by health-related costs and the restaurants and hotels sector, each adding 0.03 percentage points to the CPI inflation rate over the period.

Understanding Inflation as an Economic Indicator

Inflation serves as a vital economic indicator that tracks the speed at which general price levels are increasing across an economy. It is a focal point for policymakers, encompassing government officials and, most importantly, central bank officials who adjust interest rates to steer economic conditions.

Several methods exist for gauging inflation, but the Consumer Prices Index stands out as the predominant measure. This metric is widely accepted by economists and decision-makers as the leading benchmark for inflation both in the UK and globally.

Economists generally consider a 2% CPI inflation rate to be ideal for sustaining a robust economy. At this level, prices are expanding—reflecting positive economic activity—but at a measured pace that remains sustainable for businesses and households alike, avoiding excessive strain on budgets.

The Effects of UK Inflation on Personal Finances

Inflation exerts influence on individual finances through both direct and indirect channels.

On the direct front, inflation dictates how quickly the costs of goods and services escalate. If your earnings remain static, elevated inflation erodes your purchasing power, potentially shrinking your monthly budget’s reach or diminishing leftover funds after covering necessities.

Indirectly, inflation ripples through broader economic elements that ultimately affect your wallet. This might manifest as higher utility bills—many of which adjust yearly based on retail prices index inflation—or salary adjustments from employers. Critically, inflation shapes interest rate policies.

Central banks like the Bank of England tweak interest rates to maintain inflation at manageable levels while fostering economic expansion. In periods of high or accelerating inflation, the Monetary Policy Committee hikes rates to curb price rises. During sluggish growth phases, they cut rates to encourage activity.

These interest rate movements, in turn, impact core areas of personal finance. For instance, rising rates typically increase mortgage interest payments. Conversely, they can boost returns on savings accounts or cash ISAs.

Therefore, the current softening of UK inflation could signal potential shifts in your financial landscape at the next Monetary Policy Committee session on interest rates.