UK Average Home Price Hits £300,000 Milestone, Halifax Reports

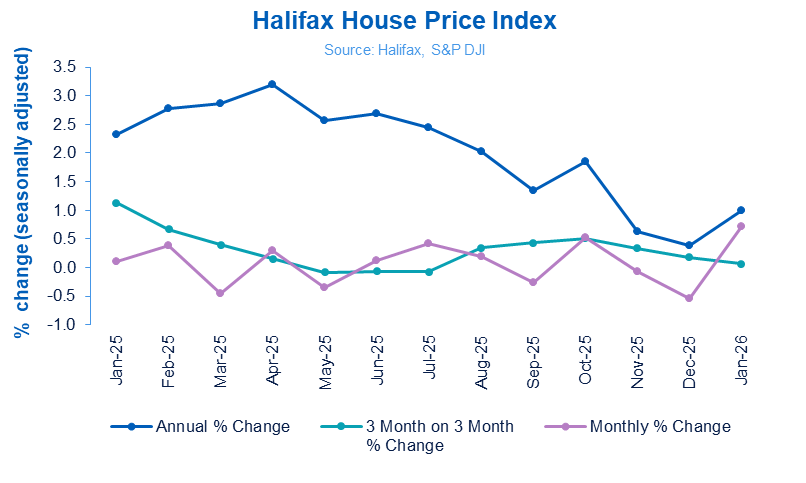

For the first time ever, the average house price across the United Kingdom has surpassed the £300,000 threshold, according to recent data from Halifax. This significant achievement comes as prospective homebuyers have made a robust comeback to the property market following a slight downturn observed in December.

Homeowners throughout the country will undoubtedly view this development positively, as it signifies that the value of their properties has climbed to unprecedented levels on average. However, for individuals aspiring to enter the housing market, this upward trajectory in prices only exacerbates the challenges associated with affordability.

The uptick recorded in January effectively counteracted the 0.5% decline seen in the previous month, setting a promising tone for house price appreciation throughout the new year.

Amanda Bryden, who serves as the head of mortgages at Halifax, highlighted that the housing sector kicked off 2026 on a solid and stable foundation. She emphasized the remarkable resilience demonstrated by market activity amid the various fluctuations experienced in recent times.

Over the course of the last three years, the typical UK house price has appreciated by 5.7%, translating to an increase of approximately £16,000. This rate of growth stands in stark contrast to the much more rapid surges that occurred during the height of the coronavirus pandemic and in the immediate aftermath.

The period from 2023 to 2026 witnessed subdued house price expansion primarily due to elevated interest rates and strained affordability conditions, which dampened buyer demand and resulted in more restrained price movements overall.

By comparison, between 2020 and 2023, property values soared by nearly 19%, equivalent to about £44,000, fueled by buyers taking advantage of historically low borrowing costs during that era.

Even though the recent three-year growth has been comparatively modest, Bryden remains optimistic about the improving vitality of the housing market moving forward.

She noted that wider economic factors are continuing to lend support to the sector. Specifically, wage increases have outstripped property price inflation since the latter part of 2022, which has gradually enhanced the fundamental affordability for potential purchasers. This ongoing positive development bodes well for aspiring buyers and contributes to the sustained robustness of the market in the long run.

Affordability Challenges Intensify with Surging House Prices

Although the escalation in house prices brings cheer to existing property owners, it presents a more sobering picture for those striving to achieve homeownership for the first time or to climb the property ladder.

As prices continue to climb, aspiring homeowners face greater hurdles in accumulating sufficient savings for a deposit while allocating an ever-larger portion of their earnings toward monthly mortgage obligations.

Nevertheless, Bryden points out encouraging indicators that affordability might see some relief this year, despite the average price vaulting past the £300,000 mark.

She explained: Affordability remains a persistent hurdle, yet robust wage progression combined with declining mortgage rates have alleviated certain pressures over recent years. We anticipate this positive momentum to persist into 2026, positioning homeownership as an attainable goal for a broader array of prospective buyers when armed with appropriate guidance and support.

Bryden further clarified that while the headline average figures might appear intimidating, particularly for first-time entrants, the majority will target more modest properties priced well below the national average.

She observed: Numerous areas provide considerably more affordable entry points, particularly in the northern parts of the country where properties are frequently available for less than £200,000.

Regional Disparities in UK House Price Growth Become More Pronounced

Substantial variations in house prices across different UK regions are hardly a novel occurrence, but these disparities have widened considerably in recent years. This trend reflects a growing chasm between price performance in northern areas and the south.

Regions in the north, along with Scotland and other devolved areas, have enjoyed consistent and vigorous house price appreciation driven by sustained high demand. Meanwhile, certain southern locales have grappled with stagnant growth or outright declines.

Northern Ireland claimed the top spot for annual price growth in 2025, with a 5.9% rise that elevated the average house price there to £217,206.

Scotland followed closely with a 5.4% annual increase, pushing its average property value to £221,711.

Within England, only the northern regions and the Midlands registered positive house price movements over the past year.

The North West took the lead among English regions, recording a 2.1% uptick to reach an average of £244,329, while the North East saw a 1.2% gain, bringing prices to £181,198.

Conversely, no southern English region achieved price growth in 2025. The most significant declines were recorded in the South West and South East, both experiencing a 1.6% drop in average prices.

Greater London also faced a contraction, with average house prices now 1.3% lower than a year prior, settling at £538,600.

| Region | Average house price | Annual change |

|---|---|---|

| Northern Ireland | £217,206 | 5.9% |

| Scotland | £221,711 | 5.4% |

| North West | £244,329 | 2.1% |

| North East | £181,198 | 1.2% |

| Yorkshire and Humber | £217,516 | 0.9% |

| East Midlands | £246,433 | 0.6% |

| Wales | £228,415 | 0.5% |

| West Midlands | £261,817 | 0.4% |

| Eastern England | £332,366 | -1.2% |

| Greater London | £538,600 | -1.3% |

| South East | £385,086 | -1.6% |

| South West | £303,625 | -1.6% |

Source: Halifax, 6 February