Top Dividend Kings: Buy Target and Coca-Cola for Life

As the S&P 500 grapples with uncertainty and lacks a definitive trajectory during the initial phase of 2026, investors are increasingly turning their attention toward reliable dividend-paying stocks. These dependable investments deliver consistent passive income streams regardless of broader market fluctuations. To fully capitalize on their advantages, the strategy is straightforward: purchase shares and maintain a long-term holding position.

Dividend stocks prove particularly valuable during periods of market volatility or flat performance, providing a steady income buffer. Yet, their utility extends even into bullish phases, where they contribute additional upward momentum to your overall portfolio. So, which specific dividend payers stand out as prime candidates for inclusion right now? In this analysis, we explore two exceptional dividend stocks worth acquiring today—companies so robust in their payout history that they merit a permanent place in your investment holdings.

1. Target

Target, trading under the ticker TGT with a recent uptick of 2.46%, holds the prestigious status of a Dividend King. This designation signifies that the company has consistently increased its dividend payouts for a minimum of 50 consecutive years. Such a remarkable achievement underscores Target’s unwavering dedication to shareholder returns through growing dividends, signaling a high probability of this trend persisting well into the future.

Currently, the retailer distributes an annual dividend of $4.56 per share, translating to an attractive yield of approximately 4%. This figure significantly outpaces the S&P 500’s modest 1.1% yield, making Target a compelling option for income-focused investors seeking superior returns on their capital.

Although Target has faced challenges in driving robust revenue expansion in recent years, which has led to some investor disappointment, the landscape appears to be shifting toward positive change. Management has implemented various strategic initiatives aimed at revitalizing performance, including a recent leadership transition where veteran executive Michael Fiddelke assumed the chief executive officer position. From a valuation standpoint, Target’s stock appears undervalued, trading at just 14 times forward earnings estimates—a notable discount from the more than 17 times multiple it commanded a year prior. This combination of factors positions the stock as an appealing entry point for those anticipating a rebound in the company’s fortunes, while simultaneously enjoying reliable dividend income in the interim.

Target’s operational strengths further bolster its appeal. As one of the nation’s leading general merchandise retailers, it benefits from a vast network of stores, a strong omnichannel presence, and a brand synonymous with quality and affordability. Recent efforts to enhance supply chain efficiency, optimize inventory management, and expand private-label offerings are expected to drive improved margins and sales growth. Moreover, with consumer spending patterns evolving, Target’s focus on everyday essentials, apparel, and home goods positions it well to capture market share. Investors buying today could benefit from both the dividend stream and potential capital appreciation as these turnaround measures take hold.

2. Coca-Cola

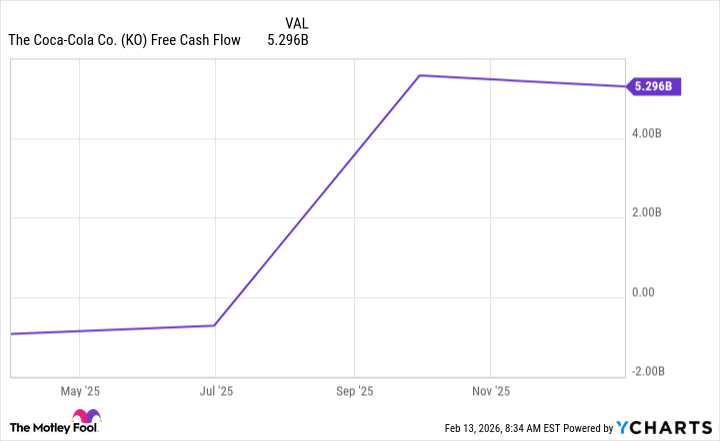

Coca-Cola, listed as KO and showing a modest gain of 0.43%, mirrors Target’s Dividend King pedigree, ensuring a dependable source of passive income for shareholders over extended periods. What sets this beverage powerhouse apart is its enormous free cash flow generation, which provides ample financial flexibility to sustain and grow dividend payments without strain.

The company currently offers an annual dividend of $2.04 per share, yielding around 2.5%—once again exceeding the S&P 500 benchmark and providing a solid income foundation for portfolios.

A key attraction for investors is Coca-Cola’s proven history of earnings expansion, fueled by an impregnable economic moat. At the core of this moat lies the company’s unparalleled brand equity. When consumers crave a classic cola, Coca-Cola is often the instinctive choice. This loyalty extends across its diverse portfolio, including powerhouse brands like Sprite, Fanta, Minute Maid, and Powerade, each commanding strong market positions and consumer preference. Global distribution networks, innovative packaging, and marketing prowess further reinforce this dominance, allowing Coca-Cola to maintain pricing power and profitability even in competitive landscapes.

Valuation-wise, Coca-Cola changes hands at roughly 24 times forward earnings projections, a multiple that has held steady over recent years. This represents a fair price for a blue-chip behemoth that rewards mere ownership with quarterly dividends. The company’s balance sheet remains fortress-like, with low debt levels relative to cash flows and a commitment to strategic capital allocation, including share repurchases alongside dividend hikes. Looking ahead, tailwinds such as premiumization trends, emerging market growth, and diversification into non-carbonated beverages like teas and waters enhance its long-term prospects.

Both Target and Coca-Cola exemplify the ideal blend of income reliability and growth potential. Their Dividend King status is no accident; it reflects decades of prudent management, resilient business models, and a shareholder-friendly culture. In today’s uncertain market environment, where volatility can erode principal value, these stocks offer a defensive anchor while positioning investors for compounded returns through reinvested dividends. By acquiring shares now at attractive valuations, you not only secure yields superior to market averages but also gain exposure to companies poised for operational improvements and sustained earnings power.

Consider the power of compounding: holding these stocks indefinitely allows dividends to be reinvested, purchasing additional shares that generate even more income over time. Historical performance illustrates this dynamic—Dividend Kings have collectively outperformed the broader market, delivering superior total returns through a combination of payout growth and moderate appreciation. For conservative investors prioritizing stability without sacrificing upside, Target and Coca-Cola warrant serious consideration as cornerstone holdings.

In summary, as market headwinds persist into 2026, pivoting toward proven dividend payers like these two can fortify your portfolio against downside risks while cultivating wealth through consistent income. Their track records, financial health, and current pricing make them not just buys for today, but forever companions in your investment journey.