Top Bank Stocks Poised to Lead Performance by 2030

Traditional bank stocks are not usually associated with explosive growth potential. Yet, when innovative technology is integrated into the banking sector to create powerful fintech solutions, certain bank stocks emerge as standout performers capable of significantly boosting investment portfolios.

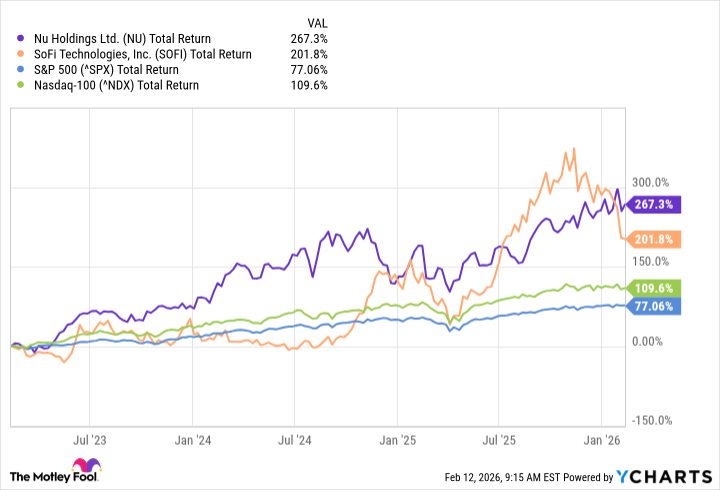

Take a closer look at Nu Holdings (NYSE: NU) and SoFi Technologies (NASDAQ: SOFI). These companies are not merely outperforming other banks; they have dramatically surpassed major benchmarks like the S&P 500 and even the Nasdaq 100 over the last three years. Their remarkable trajectories suggest they are well-positioned to continue leading the pack among bank stocks through the end of the decade.

Nu Holdings: Revolutionizing Digital Banking in Latin America

Nu Holdings operates as a fully digital banking platform primarily serving customers in Brazil, Mexico, and Colombia. Prior to its launch, the banking landscape in these regions presented significant challenges, even for wealthier individuals who could access services. High barriers to entry persisted, and a large portion of lower-income populations remained entirely excluded from formal financial systems. Until recently, Nu functioned as a non-bank financial institution, which enabled it to deliver a focused range of products without the full regulatory burdens of a traditional bank.

The company’s expansion has been nothing short of phenomenal. In Brazil alone, Nu has captured more than 60% of the adult population as users, drawing in clients from every socioeconomic background imaginable. Despite this impressive penetration, the platform is far from reaching its limits. Opportunities abound in multiple directions. For starters, Nu continues to add approximately one million new customers each month in Brazil, steadily growing its base there.

Moreover, the company is enhancing monetization strategies with its existing clientele. A significant number of users currently hold just one Nu product, and many maintain their primary banking relationships elsewhere. This presents a vast opportunity for cross-selling additional services, deepening customer engagement, and increasing revenue per user over time.

Geographic expansion offers even more promise. In Mexico, Nu serves about 14% of adults, while in Colombia, that figure stands at around 10%. These markets are ripe for further penetration, with management signaling intentions to enter additional countries. Adding to the excitement, Nu has recently submitted an application for a banking charter in the United States, which could open up an entirely new, massive market and provide regulatory advantages for broader service offerings.

Nu Holdings remains in the early stages of its transformative journey. With its aggressive customer acquisition, sophisticated product roadmap, and strategic market expansions, it is primed to deliver substantial value to shareholders not just over the next five years, but well into the future.

SoFi Technologies: A Rising Star in American Fintech

SoFi Technologies shares many similarities with Nu Holdings but tailors its approach to the U.S. market, placing a strong emphasis on lending while venturing into cutting-edge areas like blockchain-enabled products. The company aspires to rank among the top 10 financial institutions in the nation, leveraging technology to disrupt traditional banking models.

At the core of SoFi’s impressive momentum is its rapidly expanding membership. In the fourth quarter of 2025, the company achieved a milestone by onboarding a record-breaking one million new members, marking a 35% increase compared to the previous year. This brought its total membership to nearly 13.7 million. While this growth rate is accelerating, SoFi remains a relatively modest player in the vast U.S. financial landscape, ensuring a lengthy runway for continued expansion.

Lending continues to form the backbone of SoFi’s operations, representing roughly half of its overall revenue. Following a period of elevated interest rates, this segment has rebounded strongly as rates have moderated, improving loan demand and profitability. As SoFi scales and accumulates experience navigating diverse economic conditions, it becomes increasingly resilient to potential downturns or volatility ahead.

The real engine of hyper-growth, however, lies in the financial services division, encompassing non-lending offerings such as checking and savings accounts, investment platforms, and more. In the latest quarter, revenues from this segment surged 78% year-over-year, with contribution profits doubling. This diversification reduces reliance on interest-sensitive lending and builds a more stable, recurring revenue stream.

SoFi’s technology platform segment, while growing at a steadier pace, serves as a foundation for innovation. The company is harnessing this capability to roll out groundbreaking products, including its innovative all-in-one Smart Card that combines multiple financial functions seamlessly. These developments underscore SoFi’s commitment to evolving into a comprehensive financial ecosystem.

Overflowing with untapped potential across membership growth, product diversification, and technological innovation, SoFi Technologies is exceptionally well-placed to outpace traditional bank stocks in the years to come. Investors eyeing the intersection of fintech and banking would do well to monitor its progress closely.

Both Nu Holdings and SoFi exemplify how digital-first strategies, customer-centric innovation, and scalable technology can redefine the banking industry. While established banks grapple with legacy systems and bureaucratic inertia, these agile players are capturing market share, delighting users, and generating superior returns. As they execute on their ambitious visions, they stand out as prime candidates for leading performance among bank stocks through 2030 and beyond. Their ability to blend banking fundamentals with tech-driven growth positions them uniquely in a sector ripe for disruption.