Should You Buy Palantir Stock Today?

Palantir Technologies (PLTR +1.23%) has proven to be an extraordinary performer for those investors who entered early during the initial surge of the artificial intelligence revolution and maintained their positions. Over the previous three years, the company’s stock price has skyrocketed by an impressive 1,200%, fueled by consistent outperformance in earnings reports and optimistic updates on sustained market demand for its offerings.

Palantir’s Data Expertise

To begin with, it is worth providing some background on Palantir’s core operations and the factors that have propelled its remarkable success in recent years. The company specializes in developing sophisticated software platforms that collect and consolidate vast amounts of customer data, enabling users to leverage this information effectively for achieving their strategic objectives. These applications can range from making rapid, real-time decisions in high-stakes military environments to streamlining operational processes in sectors like hospitality for enhanced productivity and cost savings. Palantir serves a diverse clientele that encompasses government agencies worldwide as well as a growing roster of commercial enterprises across various industries.

A standout feature that has particularly captivated its user base is the company’s innovative AI-driven solution known as the Artificial Intelligence Platform, or AIP for short. Introduced in 2023, AIP has acted as a powerful catalyst for accelerating Palantir’s expansion. Clients value this platform immensely because it provides a streamlined, user-friendly method to integrate artificial intelligence directly into their specific workflows and requirements. Moreover, it delivers substantial cost efficiencies by eliminating the need for organizations to develop the foundational components of an AI system from scratch, allowing them to focus resources on core business activities instead.

Strong Commercial and Government Businesses

Palantir has consistently achieved robust double-digit revenue increases, driven by strong performances in both its commercial and government segments, while profitability metrics have also shown steady upward trajectories. The developments within the commercial division are especially noteworthy, considering that this area represented only a minor fraction of overall revenue just a handful of years back. The company has dramatically expanded its U.S. commercial customer base, growing from fewer than 20 clients approximately five years ago to exceeding 500 active relationships at present. In parallel, the average value of these contracts has seen substantial appreciation. To illustrate this progress, in the most recent quarterly period, Palantir secured an all-time high in U.S. commercial contract value, surpassing $1.3 billion—a remarkable 67% jump compared to the same period in the prior year.

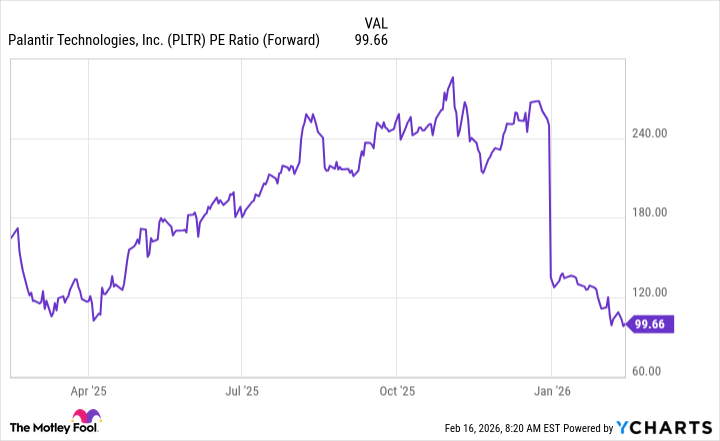

These dynamics paint an encouraging picture for Palantir’s future trajectory. However, the pressing question remains: Does the current moment represent an opportune entry point for new investors? Although the stock continues to trade at premium levels relative to traditional valuation benchmarks, the recent pullback has moderated these multiples considerably, potentially creating a more attractive entry valuation.

It is inherently challenging to forecast whether Palantir’s share price will experience further downside pressure, which could compress valuations even more in the near term. That said, attempting to perfectly time market movements is notoriously difficult and often counterproductive for long-term wealth building. Therefore, a more prudent approach involves evaluating the company’s fundamental growth potential and competitive positioning over an extended horizon. Viewed through this lens, Palantir’s narrative appears exceptionally compelling, positioning it favorably for growth-oriented investors who are willing to acquire shares at prevailing levels. Such a strategy could yield significant rewards as the company capitalizes on its expanding market opportunities in the years ahead.

One persistent challenge Palantir has encountered amid its rapid ascent is the perception of an elevated valuation, which has deterred certain prospective buyers and even led some existing holders to trim their positions out of concern that enthusiasm for the stock might wane. This sentiment has contributed to a noticeable softening in performance lately, with shares declining roughly 25% from the beginning of the year. On a brighter note, this correction has had the beneficial effect of bringing the stock’s pricing metrics back toward more reasonable territory, prompting investors to reassess whether now presents a compelling buying opportunity.

Palantir’s market capitalization currently stands at $317 billion, with the stock trading at $133.02 as of the market close on February 17, 2026, reflecting a daily gain of 1.23% or $1.61 per share. Key trading statistics include a day’s range between $127.29 and $134.32, a 52-week range from $66.12 to $207.52, and average daily volume around 45 million shares. The company’s gross margin remains impressively healthy at 82.37%, underscoring its operational efficiency and pricing power in the software space.

In summary, while short-term volatility persists, Palantir’s proven track record in AI innovation, expanding customer footprint, and robust demand signals across both government and commercial sectors make a strong case for patient, long-term investors. The recent valuation reset further enhances its appeal, potentially setting the stage for renewed upside as macroeconomic conditions stabilize and AI adoption accelerates globally.