RTX Corporation Thrives in Expanding Defense Market

RTX Powers the F-35 and Beyond

Geopolitical tensions persist around the globe, potentially impacting equity markets in various ways. These include escalating tariffs imposed by the United States, the heightened risk of a Chinese military action against Taiwan following President Xi Jinping’s consolidated power, ongoing conflicts involving Iran, and intensified Russian aggression in Europe amid shifting U.S. priorities away from NATO and the continent.

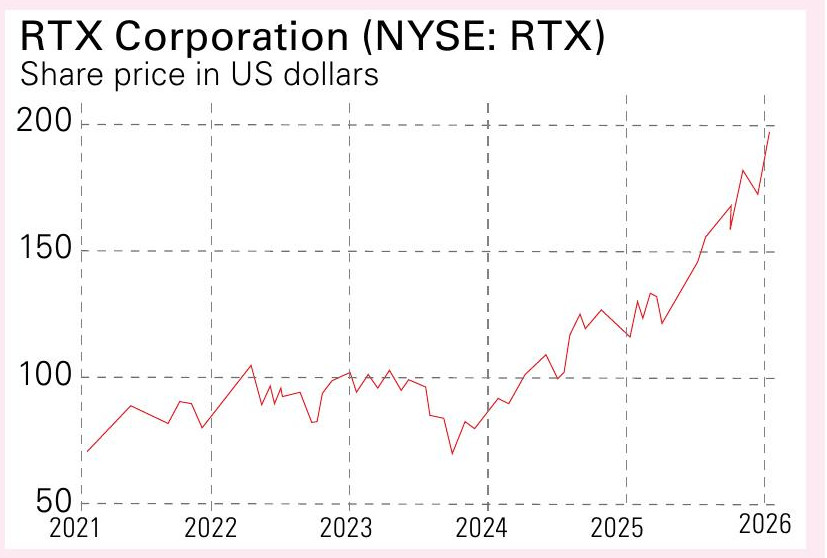

In navigating these uncertainties, investors must carefully assess their effects on financial markets while determining if the artificial intelligence sector represents an overhyped bubble or a sustained expansion opportunity. Amid such volatility, market participants are increasingly drawn to robust companies that command significant market positions within stable, high-growth industries offering reliable profitability. A prime illustration of this is the U.S.-based RTX Corporation, traded on the NYSE under the ticker RTX.

RTX operates through three major divisions of roughly equal scale: Collins Aerospace, Pratt & Whitney, and Raytheon, which specializes in missiles and munitions. Collins Aerospace delivers a wide array of products and services for both commercial and military aviation, including cockpit and cabin interiors, helicopter components, space technologies, as well as systems for airport operations and air traffic control.

Pratt & Whitney ranks as the second-largest provider of aero-engines worldwide, supplying powerplants for every category of commercial aircraft and holding a dominant position in engines for regional jets. Raytheon, meanwhile, develops an extensive portfolio of defense technologies, encompassing missiles, Patriot surface-to-air missile defense systems, Iron Dome interception networks, advanced radars, sophisticated sensors, and cutting-edge high-energy laser weapons.

The advanced F-35 Lightning II, a fifth-generation stealth fighter jet, integrates critical technologies from across RTX’s divisions. Pratt & Whitney supplies the aircraft’s primary engine, Collins Aerospace contributes the innovative helmet-mounted display system along with enhanced power and thermal management solutions, and Raytheon furnishes precision-guided munitions such as medium- and short-range missiles, smart bombs, and laser-designated bombs.

RTX’s Impressive Financial Performance

For the fiscal year 2024, RTX reported revenue of $80.7 billion, reflecting an 11% increase in organic sales compared to the previous year, supported by a substantial order backlog reaching $218 billion. The company described this influx as demonstrating unprecedented customer demand. Projections shared in January 2025 anticipated adjusted sales for the full year between $83 billion and $84 billion, with adjusted earnings per share ranging from $6.00 to $6.15. Actual results announced on January 27 exceeded expectations, delivering $88.6 billion in revenue and $6.29 in adjusted earnings per share, prompting a nearly 4% surge in the stock price. These figures incorporate adjustments related to the sale of a non-essential business unit within Collins Aerospace. By January 2026, the order backlog had swelled further to $268 billion.

Four Key Pillars Driving RTX’s Expansion

RTX’s diversified product lineup across commercial and military sectors in three expansive market segments ensures more foreseeable growth trajectories. The company benefits from four primary catalysts for expansion. First, its massive and steadily growing order backlog provides exceptional visibility into forthcoming revenue streams. As production scales to address this backlog, RTX leverages economies of scale that lower per-unit costs; combined with ongoing internal efficiency initiatives, these dynamics widen profit margins, enabling earnings to outpace revenue growth.

Second, the commercial aerospace aftermarket is rebounding strongly after the disruptions of the Covid-19 pandemic. This resurgence heightens demand for spare parts, maintenance services, and upgrade projects, particularly benefiting Collins Aerospace and Pratt & Whitney. Notably, this aftermarket segment boasts superior margins and has recently posted double-digit growth rates.

Third, rising global defense expenditures worldwide are fueling demand for RTX’s missile systems, radar technologies, and electronic warfare capabilities. Fourth, substantial investments in research and development are propelling innovations in next-generation propulsion for aircraft, novel advanced materials, and AI-powered data analytics that optimize operational efficiency across the board.

Detailed Insights into RTX’s Financial Engine

RTX’s enormous order backlog, coupled with these four growth engines, positions the company for multiple years of earnings expansion surpassing sales growth. The full-year 2025 results, covering the period ending December, revealed sales of $88.6 billion, operating profit of $10.85 billion, adjusted earnings per share of $6.29, free cash flow of $7.9 billion, and an order backlog climbing to $268 billion.

During 2025, RTX secured $138 billion in fresh orders. These outcomes demonstrated 11% organic growth in sales and 10% in earnings per share. Looking ahead to 2026, management guidance projects sales between $92 billion and $93 billion, earnings per share from $6.60 to $6.80, and free cash flow ranging from $8.25 billion to $8.75 billion.

The fourth quarter of fiscal 2025 stood out as particularly stellar, with sales hitting $24.2 billion—a 14% organic increase. Pratt & Whitney led the charge, achieving 25% sales growth fueled by a 21% uptick in commercial aftermarket activity, a 28% jump in commercial original equipment sales, and a 30% rise in military sales, largely attributable to accelerated F-35 production rates.

Key highlights from the 2025 performance include strategic commitments to future innovation, evidenced by $2.63 billion in capital expenditures, $7.4 billion allocated to research and development, and a 20% increase in munitions sales. The munitions portfolio features standout products like the GEM-T guided tactical missile, the AMRAAM air-to-air missile for medium-range engagements, and the Coyote missile designed to neutralize small drones.

RTX enjoys a privileged market stance, with all three divisions delivering profitable growth, underpinned by transparent drivers and an order backlog equivalent to three full years of sales. Trading at a recent share price of $199.3, the forward price-to-earnings ratio for 2026 stands at 29.3, projected to decline to 24.2 by 2028. The anticipated dividend yield is 1.4%, with payouts steadily increasing since 2021. Over the past year, shares have appreciated by 59.7% and appear poised for further gains.