Nvidia Set for Another Earnings Double Beat Preview

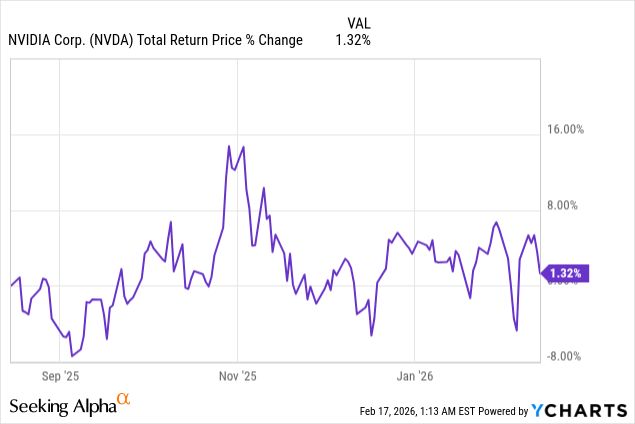

Nvidia Corporation’s shares have experienced a period of consolidation since the beginning of August 2025, displaying essentially flat performance throughout the subsequent six months. This phase of price stability comes amid shifting investor sentiments in the growth stock arena.

Consolidating Ahead of Strong Earnings Performance

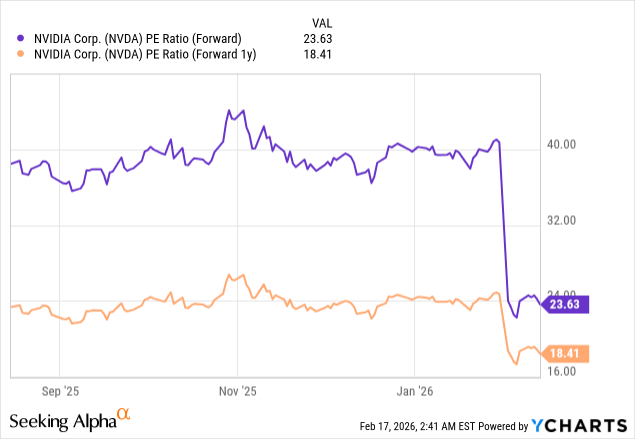

The attention of growth-oriented investors has undergone a significant transformation in recent months, diverging from the intense enthusiasm observed during 2022-2024. Back then, Nvidia was widely regarded as the primary beneficiary of the artificial intelligence boom across the market. Much of that earlier optimism has now been incorporated into the stock’s valuation. Consequently, doubts have emerged, with questions arising such as whether the return on invested capital for AI-related expenditures might prove underwhelming, or if major cloud providers could reduce or cancel orders for Nvidia’s products in the near term. These uncertainties have eroded the premium previously embedded in Nvidia’s valuation, creating hesitation among investors.

Nevertheless, the prevailing worries about Nvidia’s competitive position do not appear entirely warranted. Demand for its offerings continues to demonstrate robustness. Even as the broader market grapples with the implications of escalating capital expenditures in AI infrastructure, Nvidia is poised to remain insulated from adverse effects, at least over the short to medium term. Analysts consistently revise forward earnings estimates upward following each earnings release from the company. When evaluated against traditional valuation measures, the stock appears undervalued relative to the anticipated growth trajectory over the coming years.

This ongoing consolidation phase seems constructive, setting the stage for the forthcoming earnings disclosure. In my assessment, the results will reinforce positive sentiment among investors, prompting further upward adjustments to revenue and earnings per share projections. Should the stock price fail to respond favorably, Nvidia would emerge as profoundly undervalued on a forward-looking basis, given its current attractive pricing. I maintain my “Buy” recommendation on Nvidia without alterations in anticipation of the earnings release scheduled for February 25, 2026.

Key Pillars Supporting Nvidia’s Bullish Outlook

Prior to examining consensus forecasts and prior management guidance, it is essential to highlight the fundamental drivers that underpin Nvidia’s sustained momentum moving forward.

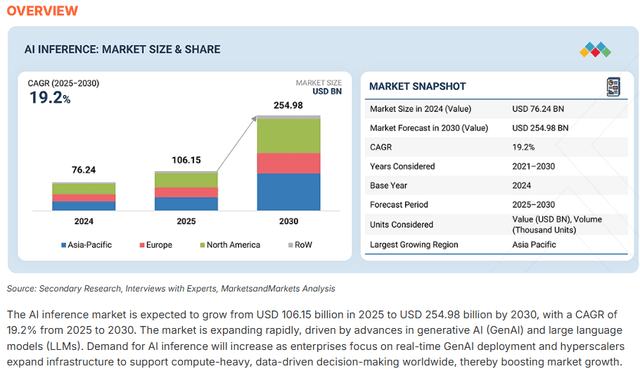

A pivotal milestone approaches where Nvidia must demonstrate the profitable scalability of its comprehensive AI operating system. This ecosystem extends beyond mere chips and server racks to encompass the full suite of supporting technologies, all while navigating intensifying competition. The underlying market demand appears resilient, particularly as the industry transitions from model training to inference workloads. Inference demands substantial computational resources and dependable software-hardware integrations, areas where Nvidia excels through offerings like the Blackwell platform, Hopper GPUs such as the H100 and H200, and TensorRT-LLM software. Projections indicate that the total addressable market for AI inference will expand by more than double within the next five years.

Nvidia’s strategic approach stands out because the company recognizes the superiority of its integrated systems compared to alternatives currently available. Rather than solely peddling individual GPUs, Nvidia has pivoted toward offering turnkey solutions akin to “automated miners,” including advanced agentic software. For instance, Nvidia AI Enterprise software commands approximately $4,500 per GPU annually, establishing a high-margin, subscription-based revenue model. This diminishes reliance on perpetual hardware production cycles, thereby constraining cost of goods sold fluctuations. Such innovations fundamentally alter the cyclical patterns that traditionally plagued semiconductor firms like Nvidia during past industry downturns. Additionally, the introduction of “Digital Workers” powered by NIM microservices creates a formidable competitive barrier that rivals are unlikely to breach in the foreseeable future. Consequently, pressures on Nvidia’s profit margins should remain contained, bolstered by these software-driven revenue layers.

An often-overlooked aspect of Nvidia’s mid-term dominance lies in its command over the sector’s hardware production rhythm. By late 2026, Taiwan Semiconductor Manufacturing Company is expected to achieve a production capacity of 150,000 CoWoS wafers monthly, with Nvidia securing roughly 60% allocation. This dynamic exemplifies a strategic monopsony, where one dominant buyer effectively steers market supply. Competitors, including Advanced Micro Devices, despite their own merits, will scramble for residual capacity. Nvidia thus holds the reins on the industry’s evolution, transitioning seamlessly from the Blackwell ramp-up to its most groundbreaking initiative yet: the Vera Rubin (R100) architecture.

The Rubin platform is slated for unveiling toward the end of 2026, featuring an integrated stack comprising the Vera CPU with 88 custom Olympus Arm cores, the Rubin GPU, NVLink 6 interconnects, ConnectX-9 SuperNIC, BlueField-4 data processing unit, and Spectrum-6 Ethernet switch. This comprehensive offering delivers critical advantages for Nvidia’s customers, including up to fivefold improvements in inference efficiency and 3.5 times superior training capabilities for large language models. Moreover, it slashes inference costs per token by as much as tenfold, requiring only one-quarter the GPU count compared to contemporary Blackwell deployments. Recent reports confirm that Rubin has entered full production, signaling the potential onset of a fresh upgrade cycle that could propel Nvidia’s financial performance, mirroring the uplift from prior Blackwell deployments.

Analyzing Expectations for Nvidia’s Next Earnings Report

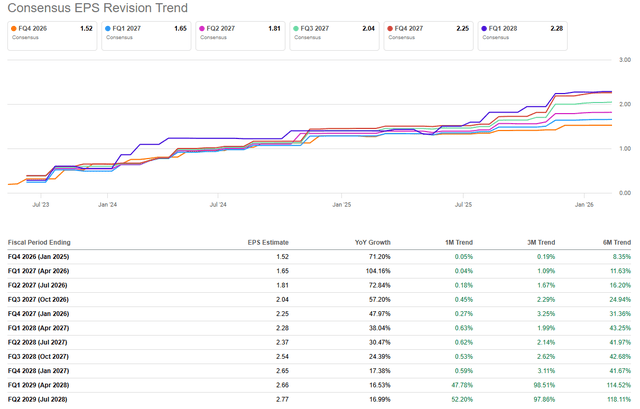

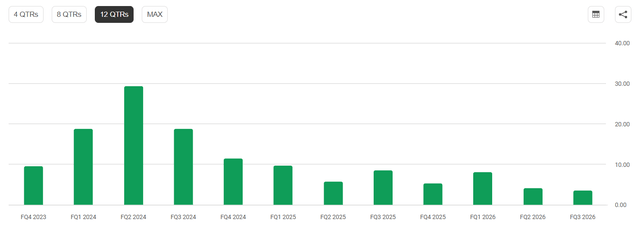

Turning attention to the specifics of the upcoming earnings, despite the stock’s stagnation over the past six months, analyst revisions to forward earnings per share have been notably aggressive. In certain periods, such as the first half of 2029, consensus estimates have effectively doubled.

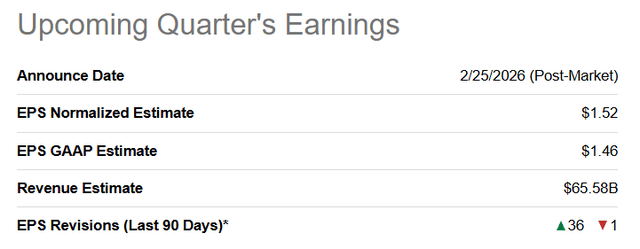

Nvidia will disclose its fiscal fourth quarter 2026 results on February 25, 2026. During the previous earnings conference, management provided guidance for $65.00 billion in revenue, with a tolerance of plus or minus 2%, alongside a non-GAAP gross margin of 75% plus or minus 50 basis points. For the entirety of fiscal 2027, executives affirmed intent to sustain gross profit margins in the mid-70% range, which has catalyzed the upward trajectory in analyst projections for that year.

The prevailing consensus from 43 analysts anticipates $65.58 billion in fourth-quarter sales, falling short of management’s guidance ceiling. This is noteworthy, given Nvidia’s track record of surpassing its own upper guidance thresholds with substantial buffers in recent quarters.

Consider the historical pattern: For the first quarter of 2026, guidance centered on $43 billion plus or minus 2%, establishing an upper bound of $43.86 billion; actual results reached $44.06 billion, exceeding expectations. In the second quarter, revenue outlook was pegged at $45 billion plus or minus 2%, yet the company delivered $46.74 billion against an upper target of $45.9 billion, a 1.8% overrun. For the third quarter, projections stood at $54 billion plus or minus 2%, but revenues hit $57 billion, surpassing the high end by more than 3.4%.

While historical performance does not assure replication, the current consensus sitting $720 million below a guidance high end routinely outperformed raises eyebrows. Typically, such reliability prompts analysts to embed a premium atop the guidance maximum. My view is that the conservative consensus reflects a tactical choice to ensure Nvidia delivers another top-line surprise, though this remains speculative intuition.

Projecting forward, assuming net income margins align with those from the January 2024 quarter (considering gross margin parallels) and factoring a 1% beat on guidance’s high end consistent with recent trends, non-GAAP net income could approximate $37.50 billion. With shares outstanding potentially declining to 24.4 billion, this translates to non-GAAP earnings per share of about $1.54, edging 2 cents above prevailing consensus.

These estimates suggest fourth-quarter revenues of $66.963 billion and EPS of approximately $1.53, representing 2.1% and 1.11% premiums over consensus, respectively. Modest in isolation, these align seamlessly with Nvidia’s multi-quarter beat pattern.

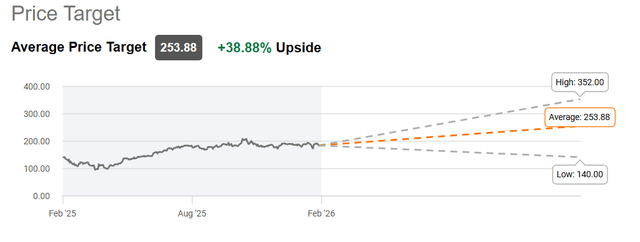

Should these projections hold, analysts are poised to elevate fiscal 2027 through 2029 estimates. The stock, already trading at compelling levels post-prior adjustments, should re-rate upward in response. I anticipate a 5% uplift to fiscal 2027 EPS consensus post-earnings, implying a price target of around $223.49 per share at 25-30 times earnings—22-23% above current levels. Broader Wall Street consensus tilts even more optimistic.

Potential Risks and Counterarguments

Market apprehensions surrounding subdued returns on AI investments could exceed my expectations. Even a solid earnings beat might falter if management cannot assuage doubts on demand durability, potentially triggering a prolonged post-earnings pullback.

My revenue and EPS projections carry inherent uncertainties, relying on assumed margins and share counts. Deviations could prove substantial and adverse. A failure to deliver the anticipated double beat might precipitate a sharp stock decline, notwithstanding efforts to pivot focus toward Rubin or other innovations.

Final Assessment

Acknowledging existent risks and market trepidations, Nvidia’s shares nonetheless present a compelling value proposition given the extraordinary growth potential from its unparalleled positioning and innovative portfolio. Projections indicate a high likelihood of exceeding earnings expectations, with positive stock implications. My 12-month target exceeds the current price by 22-23%, sustaining a bullish stance on Nvidia for the medium term.