Nebius Group Stock: Path to 10x Portfolio Growth

Understanding Nebius Group’s Position in the AI Infrastructure Market

Nebius Group, trading under the ticker NBIS, stands out as a vital contributor within the artificial intelligence sector. The company specializes in delivering essential computing resources to businesses aiming to develop, train, and implement AI models and applications through cloud-based services. By operating specialized AI data centers outfitted with advanced graphics processing units, or GPUs, Nebius ensures that its clients have access to the high-performance hardware required for complex AI operations.

In addition to its hardware offerings, Nebius provides a comprehensive array of software tools designed to assist customers in training AI models, customizing them for specific needs, deploying them efficiently, and scaling operations as demand grows. This complete, full-stack AI infrastructure platform has garnered substantial interest from industry leaders, including major hyperscalers who have committed to long-term contracts that promise steady revenue streams for the foreseeable future.

The surging demand for Nebius’s services is evident in its impressive stock performance, which has surged by 120% over the previous year. Despite this strong upward trajectory, analysts and investors continue to see considerable potential for further appreciation, particularly as the company positions itself firmly within one of the fastest-expanding segments of the technology landscape. Exploring the factors driving this momentum reveals why Nebius could serve as a cornerstone for long-term wealth accumulation strategies.

Nebius Group’s Remarkable Expansion Trajectory

Projections indicate that data center power requirements in the United States will more than quadruple, rising from 25 gigawatts in 2024 to an astounding 106 gigawatts by 2035, largely propelled by the insatiable appetite for AI-driven computing power. This explosive growth creates a prime investment opportunity, especially amid the ongoing shortage of available data center capacity tailored for AI training workloads. Nebius is actively addressing this gap by aggressively expanding its network of data centers to meet the escalating needs of cloud-based AI applications.

In 2024, the company managed only two operational data center sites. By the following year, this figure had expanded dramatically to seven sites. Looking ahead, Nebius anticipates operating a robust total of 16 data center locations across the United States and Europe by the close of 2026. Its active data center power capacity reached 170 megawatts in 2025, surpassing the initial target of 100 megawatts and demonstrating efficient execution on growth plans.

Even more compelling is the company’s access to over 3 gigawatts of contracted data center power capacity. This secured power represents agreements with utility providers that enable Nebius to develop new facilities equipped with GPUs, advanced cooling systems, and other critical infrastructure. Notably, this contracted capacity dwarfs the active capacity by nearly 20 times as of the end of 2025. As Nebius methodically activates this reserved power, transforming contracts into fully operational sites, its revenue streams are poised for exponential acceleration.

Financial results for 2025 underscore this progress, with revenues climbing to $530 million—a staggering nearly sixfold increase from the prior year. Industry forecasts predict an even more dramatic upswing in the coming years, fueled by the company’s strategic expansions and the broader AI infrastructure boom. These developments position Nebius not merely as a participant in the market but as a leader capitalizing on the structural tailwinds of AI proliferation.

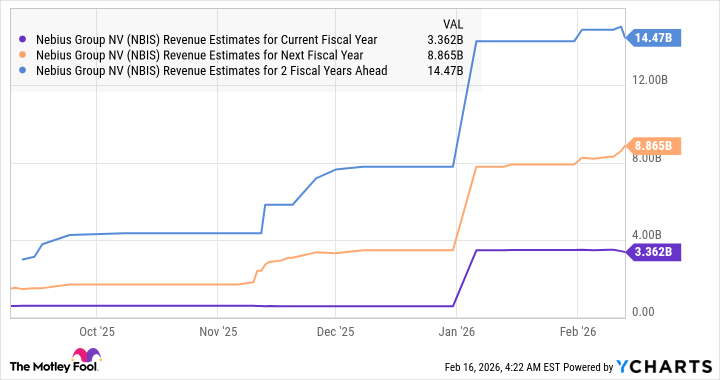

The chart above illustrates the anticipated revenue trajectory for Nebius Group, highlighting the sharp upward curve expected through the current fiscal year and beyond, based on data from reliable financial analytics sources.

Potential for Substantial Stock Appreciation

Achieving a tenfold increase in personal net worth represents a monumental financial goal that demands careful consideration and strategic planning. While placing all hopes on a single stock like Nebius carries inherent risks—particularly if growth falters or market conditions shift—incorporating it into a well-diversified investment portfolio could yield transformative results. The AI data center sector is witnessing unprecedented capital inflows, with trillions potentially allocated to infrastructure development over the coming decade.

Nebius’s revenue is forecasted to expand by an extraordinary 27 times from the previous year’s baseline over the next three years. Should the company realize $14.5 billion in annual revenue by 2028, as projected, and maintain a sales multiple of 8.4 times—aligned with the broader U.S. technology sector average—its market capitalization could soar to approximately $122 billion. This would mark nearly a fivefold increase from current levels, offering investors substantial returns even under conservative valuation assumptions.

Given Nebius’s superior growth profile compared to many peers, the market may assign it a premium valuation multiple, further amplifying potential upside. Factors such as execution on data center rollouts, contract fulfillment with hyperscalers, and sustained AI demand all contribute to this optimistic outlook. Investors should weigh these opportunities against risks like execution challenges, competitive pressures, and macroeconomic fluctuations, but the fundamentals suggest Nebius remains a compelling candidate for long-term holding.

Strategic Insights for Investing in Nebius Group

Recent earnings reports from Nebius highlight not only solid performance but also management’s confidence in scaling operations significantly. The company is on pace to multiply its AI data center footprint this year, backed by abundant contracted power resources that will fuel revenue acceleration across the next three years. Even trading at valuations comparable to the U.S. tech sector, Nebius stock demonstrates capacity for remarkable gains, making it an attractive option for growth-oriented portfolios.

The combination of expanding active capacity, a vast pipeline of contracted power, and skyrocketing demand for AI infrastructure positions Nebius uniquely. As more enterprises race to harness AI capabilities, Nebius’s role in providing scalable, high-performance cloud solutions becomes increasingly indispensable. This structural advantage, coupled with proven revenue momentum, underpins the potential for the stock to deliver multibagger returns over time.

For investors eyeing exposure to the AI revolution, Nebius Group offers a direct play on the infrastructure layer that powers it all. While past performance does not guarantee future results, the company’s trajectory—from modest beginnings to a multi-site operator with gigawatt-scale ambitions—signals a trajectory aligned with the sector’s explosive potential. Incorporating Nebius thoughtfully into a balanced strategy could indeed contribute meaningfully to substantial wealth growth objectives.