LVS Advisory Q4 2025 Investor Letter: Performance Review

Dear Investors

Throughout the entire year of 2025, the LVS Event-Driven Portfolio delivered a solid return of 9.1%, while the LVS Growth Portfolio achieved 6.2%, all net of fees and expenses. These figures stack up against the high-yield bond index, which rose by 8.8%, and the S&P 500, which climbed 17.9%, serving as our respective benchmarks for performance evaluation.

In this comprehensive letter, I will delve into the exciting launch of a leveraged iteration of the Event-Driven portfolio—a fresh strategy for LVS Advisory—and provide a detailed analysis of the Growth Portfolio’s performance throughout 2025.

Strategy Launch: Levered Event-Driven

Back in 2019, when I first introduced the Event-Driven strategy, my primary objective was to craft a portfolio characterized by low volatility and minimal correlation to broader markets, capable of delivering consistent high-single-digit annual net returns. Now, seven years on, I take great pride in confirming that this ambition has been fully realized. The strategy has demonstrated a maximum drawdown of just 5.3% and has avoided any down years, all while steadily surpassing liquid income strategies—a testament to its enduring strength.

For quite some time, I have held the conviction that incorporating leverage could amplify these returns to even greater heights. However, I refrained from pursuing this avenue for several practical reasons. Chief among them was the understanding that leverage inherently amplifies volatility, and since I was already overseeing the Growth Portfolio—a vehicle designed for higher volatility and correspondingly higher returns—it seemed redundant. Additionally, the capital base at the time was insufficient to effectively seed such innovative expansions.

Yet, circumstances shifted notably in 2025. The landscape for Merger Arbitrage and other Event-Driven opportunities expanded significantly, fueled by a surge in merger and acquisition activity, falling interest rates, and a more permissive regulatory backdrop. These tailwinds directly propelled the Event-Driven Portfolio to its impressive 9.1% net return for the year, with that positive momentum spilling over into early 2026.

Concurrently, the U.S. stock market reached unprecedented valuation peaks, largely propelled by a concentrated group of technology stocks that now constitute approximately half of the S&P 500’s total market value. Although I maintain a long-term bullish stance on U.S. equities, the extreme concentration and elevated valuations in the S&P 500 have instilled a sense of caution regarding new capital deployments into the broader market.

In this environment, I see a compelling case for diversifying away from U.S. stocks and, more specifically, from heavy reliance on the S&P 500 index.

To explore this further, last summer I undertook a rigorous study examining the effects of applying different levels of leverage to the Event-Driven Portfolio. Utilizing the actual daily returns from seven full years of strategy execution, I modeled scenarios involving margin purchases and associated interest costs. Although hypothetical in nature, this analysis carries substantial credibility, as it is grounded in genuine daily return data spanning diverse market conditions—including periods of elevated and subdued interest rates, as well as severe sell-offs in 2020 and 2022.

The outcomes proved remarkably encouraging. A conservatively levered variant of the strategy would have produced returns competitive with the S&P 500 across the past seven years, yet with significantly reduced downside exposure—less than half the risk. I refrain from quoting precise metrics in this letter, but I am more than willing to share the detailed data upon request.

With the support of a substantial family office, we officially launched the strategy in October 2025. It is now accessible to accredited investors through separately managed accounts. Looking ahead, we are actively considering the establishment of a dedicated hedge fund structure for this approach sometime in 2026.

For existing investors in the unlevered Event-Driven Portfolio, nothing changes—continuity remains paramount. The levered version mirrors the exact same positions, eliminating any need for additional analytical resources to oversee it. Recognizing that a higher-risk profile does not suit every investor, I value the flexibility of providing both options to meet diverse preferences and risk tolerances.

Growth Portfolio: 2025 in Review

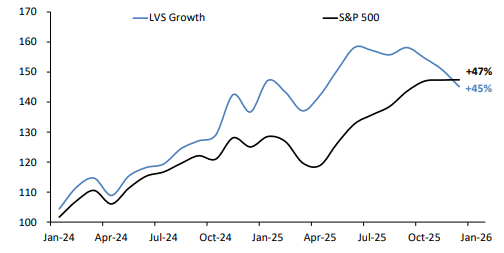

The tidings for the Growth Portfolio are somewhat less triumphant. Having outperformed the S&P 500 through the first three quarters of 2025, the strategy encountered a setback with an 8.2% decline in the fourth quarter, resulting in full-year underperformance relative to the benchmark. I share the disappointment in this conclusion to the year, yet a broader perspective over the preceding two years reveals performance aligning closely with the S&P 500.

The following table outlines the primary stocks and themes that negatively impacted our performance in Q4 2025.

| LVS Investment | Q4 ’25 Impact to Overall Portfolio |

|---|---|

| Netflix (NFLX) | -4.04% |

| Power Basket | -1.60% |

| Software Basket | -1.50% |

| Fintech Basket | -1.17% |

| Total | -8.31% |

Netflix

Netflix continues to represent our most substantial holding, maintaining an 18% portfolio weight at the onset of Q4. The stock experienced a sharp 21.8% drop during the quarter, largely triggered by the announcement of its $83 billion acquisition of Warner Brother Discovery (WBD).

As background, we initiated a 6% position in Netflix back in 2022 at an average cost basis of $28.31. It evolved into our top holding as the investment thesis validated itself through substantial price appreciation—without any subsequent additions or reductions since inception. I retained the position due to my conviction in further upside potential. Netflix has solidified its dominance as the preeminent global force in scripted entertainment, steadily capturing market share from traditional linear television. I anticipate this trajectory will persist as the company channels investments into live entertainment, sports programming, video gaming, and enhanced advertising features.

Before the Warner Brothers acquisition—which caught us off guard—the principal risks I identified were competitive pressures from short-form video platforms like TikTok and user-generated content hubs such as YouTube. That said, I also regard these as avenues for future expansion. Netflix’s recent introduction of podcasts, for instance, aligns closely with YouTube’s popular content ecosystem. In essence, Netflix has consistently excelled in executing growth strategies, and I have faith in the management’s ability to adeptly steer through evolving dynamics in the entertainment sector.

Currently, Netflix shares languish about 40% below their mid-2025 peaks, reflecting investor skepticism over the perceived premium paid for Warner Brother Discovery. My stance on the deal remains balanced. While Netflix did not urgently require a major studio acquisition, the opportunity arose opportunistically amid Warner’s sale process. Warner possesses one of the industry’s premier content libraries and film production capabilities. Netflix stands well-positioned to extract enhanced value from these assets. Moreover, this represents a rare, generational chance to acquire such a sizable and high-quality entertainment asset. Admittedly, the price and accompanying debt raise concerns, but Netflix’s scale equips it to manage the financial implications effectively. Critically, control of these content resources should expedite Netflix’s broader growth objectives.

Valued at approximately 20 times forward expected earnings, the stock appears remarkably undervalued, especially considering projections of 20%+ annual earnings growth over the coming three years—even absent acquisition synergies. From the present levels, this setup presents a favorable risk-reward profile: Netflix’s shares are poised for strong performance irrespective of the Warner integration’s outcome over the medium to long term.

Power Basket

In the Q3 2025 letter, I dedicated extensive coverage to our power sector thesis. Little has changed since then to warrant further elaboration. While the constituent stocks have exhibited notable volatility, the overarching long-term trends remain compelling and supportive of our positioning.

Software Basket

Our exposure consisted of modest stakes in select software firms. The broader software sector faced headwinds from apprehensions that artificial intelligence would intensify competition and erode customer switching costs. Like many in the investment community, our team has invested considerable effort in dissecting artificial intelligence’s multifaceted implications across industries. Regarding software specifically, constructing a clear vision of the future proves challenging. It is difficult to contend that AI will bolster the terminal valuations of most publicly traded software enterprises. Starting 2025 with already elevated multiples, any diminishment in long-term value creation would pose significant hurdles to valuation recovery. Consequently, I opted to exit our software positions entirely and reallocate elsewhere.

Nevertheless, I continue to identify merit in tech platforms leveraging physical scale economies, powerful network effects, and enduring brand moats. In contrast to software—which has arguably commoditized further over the past three years—these platforms are primed to capture AI-driven value accrual. Their customer relationships extend beyond purely digital interactions, positioning them to leverage AI for superior service delivery and operational efficiencies.

Fintech Basket

This basket encompasses holdings in Interactive Brokers and Wise. These names have displayed volatility tied to interest rate fluctuations and consumer spending patterns. In 2025, stablecoins emerged as a fresh risk narrative. After thorough examination, I assess no imminent threat of disruption to our fintech investments. Wise faces somewhat higher vulnerability, as cross-border payments rank among crypto and stablecoin’s touted applications. To date, however, stablecoins have gained limited foothold in this space owing to cost structures far exceeding established payment networks. Wise has sustained robust financial results, reinforcing that these concerns remain hypothetical for now.

That said, this dynamic merits vigilant oversight, as technological shifts can accelerate rapidly—a lesson echoed in the software basket’s fate. I remain optimistic that Wise can integrate stablecoin innovations while upholding its disruptor credentials. The company’s proven execution history bolsters my confidence in management’s strategic judgment.

Semiconductors

Our relative underperformance was exacerbated by a complete absence of semiconductor exposure throughout 2025. Despite strong enthusiasm for artificial intelligence’s transformative potential, I steered clear of semis due to the sector’s technical complexity and dominance by specialized experts. Conventionally, it has exhibited extreme cyclicality and volatility—traits I generally eschew in portfolio construction.

Retrospectively, this omission proved the most significant drag on relative returns. Semiconductors accounted for roughly 8% of the S&P 500’s 17.9% advance in 2025—nearly half the index’s gains. Absent their contribution, the S&P would have returned only about 12% for the year.

I do not anticipate a major pivot toward loading up on semiconductor stocks imminently, but this experience has prompted greater openness to sectors beyond my core competency, fostering a more adaptive approach.

What We Got Right in 2025

To conclude on an upbeat note, several elements of our 2025 playbook delivered strongly. The power basket shone, with Talen Energy doubling in value and Curtiss-Wright surging 64%. Interactive Brokers sustained its compounding trajectory, gaining 48%. We also realized gains from tech platforms including Google (GOOG), Amazon (AMZN), and Meta (META), alongside our healthcare allocations spanning pharmaceutical distributors and medical device manufacturers.

Until Next Time

I enter 2026 with renewed vigor, determined to deliver exceptional results. The rollout of the Levered Event-Driven strategy fills me with enthusiasm, complemented by a pipeline of promising new opportunities I eagerly anticipate sharing in forthcoming updates.

Thank you once again for your steadfast support and confidence in LVS Advisory.

Best regards,

Luis V. Sanchez CFA