Jack Bogle’s Easy Portfolio Adjustment for Over-50 Investors

Investing does not demand poring over corporate earnings statements or expert forecasts to pinpoint the next big stock winners. Actually, the secret to achieving enduring financial objectives frequently lies in maintaining a straightforward investment strategy.

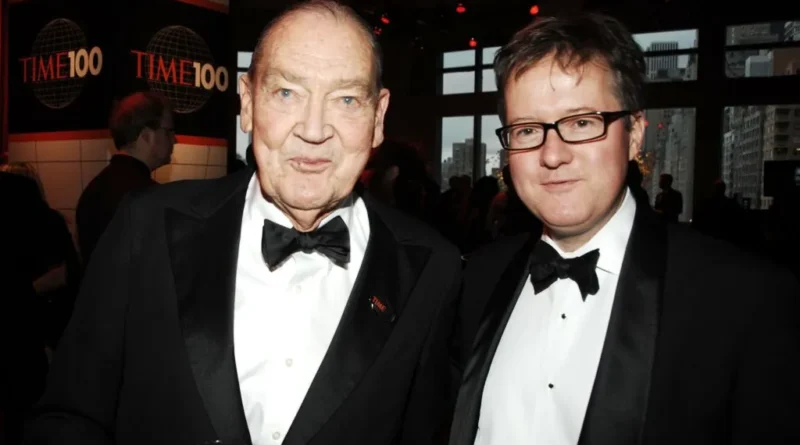

Jack Bogle, the founder of Vanguard, revolutionized the investment world by championing low-cost strategies, which paved the way for accessible mutual funds and exchange-traded funds (ETFs). If you have reached your 50s and are approaching retirement, you might be pondering the best way to realign your investment portfolio with your current risk appetite, remaining time until retirement, and personal financial aspirations. Bogle’s emphasis on low-cost investing provides a practical solution, and putting it into practice is remarkably straightforward.

The Compounding Benefits of Minimizing Investment Fees

Switching to low-cost index funds from those burdened with elevated expense ratios may not deliver immediate boosts to your returns, but over extended periods, the accumulated savings can be substantial. Numerous ETFs that track major indices like the S&P 500 or other widely followed benchmarks boast expense ratios under 0.10%, rendering them highly competitive. In stark contrast, funds with 1% expense ratios appear far less appealing when scrutinized closely.

Consider this example: An individual holding a $500,000 portfolio in funds charging a 1% expense ratio would incur $5,000 in annual fees. By comparison, allocating the identical sum to funds with a mere 0.25% expense ratio would limit fees to only $1,250 per year. This disparity compounds dramatically over decades, potentially adding tens or even hundreds of thousands of dollars to your nest egg through the magic of reduced costs and reinvested savings.

Why a Simple Strategy Lowers Risks for Investors Nearing Retirement

Bogle advocated for a disciplined method centered on a select group of broad-based index funds held over lengthy durations. This approach ensures your financial growth is not tethered to the performance of any individual stock or narrow industry sector. During robust bull markets, your portfolio can capture substantial gains, yet in downturns, bear markets, or market corrections, the drawdowns tend to be milder and more manageable.

By committing to regular purchases of index fund shares through dollar-cost averaging—perhaps monthly investments regardless of market conditions—and resisting the urge to sell during volatility, you sidestep emotionally driven choices that often lead to suboptimal outcomes. This disciplined, hands-off philosophy fosters steady wealth accumulation, smoothing out the market’s inevitable ups and downs while prioritizing long-term preservation and growth.

Adopting the Bogle Investment Philosophy in Your 50s

Transitioning to Bogle’s principles in your 50s typically demands minimal upheaval to your existing setup. Begin with a thorough review of your current holdings to identify the specific funds comprising your portfolio and the fees they entail. Should your investments lack sufficient breadth—spanning equities and fixed income, U.S. and global markets, large-cap and small-cap companies, as well as various sectors—consider reallocating to funds that enhance diversification across these categories.

If the ongoing fees exceed what feels reasonable, you have the option to liquidate positions in pricier funds and redirect those proceeds into cost-efficient alternatives that align better with Bogle’s tenets. This shift not only trims expenses but also bolsters the resilience of your portfolio against unforeseen market shifts.

As retirement draws nearer, it becomes prudent to fully fund your retirement vehicles to capitalize on available tax incentives. Roth accounts offer the perk of tax-free distributions in retirement, whereas traditional plans provide upfront tax deductions on contributions, allowing funds to grow sheltered from immediate taxation.

Evaluate your present tax circumstances alongside projections for your future tax bracket to decide the optimal account types for your contributions. Incorporating tax diversification further mitigates potential pitfalls: Savvy investors often balance contributions across employer-sponsored plans such as 401(k)s, personal IRAs, and even taxable brokerage accounts. This multi-pronged strategy minimizes tax liabilities in retirement, enhances flexibility, and safeguards against regulatory or personal changes that could impact any single account type.

Ultimately, Bogle’s timeless wisdom underscores that simplicity, low costs, and diversification form the bedrock of successful investing, particularly for those in the later stages of their careers. By embracing these principles, individuals over 50 can confidently navigate toward a secure financial future without unnecessary complexity or expense.