J.P. Morgan: Flawed Reasoning Fuels Software Stock Decline

Market participants may be responding excessively to concerns surrounding artificial intelligence and its potential effects on software company equities.

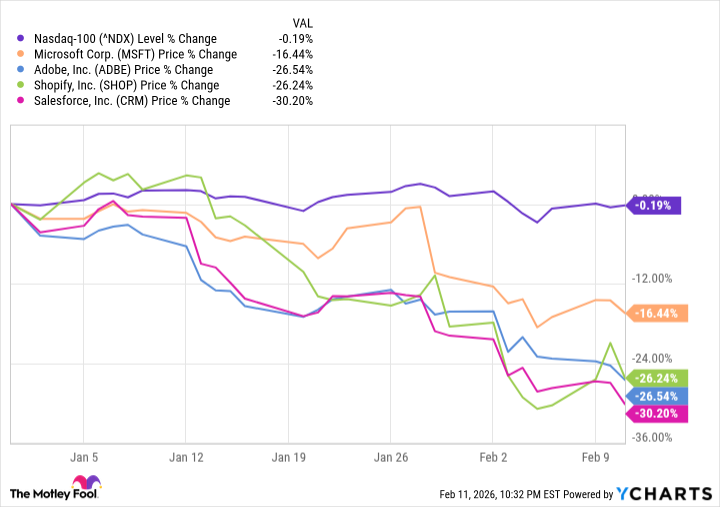

The downturn in software equities has emerged as one of the most prominent investment patterns in 2026. The technology-dominated Nasdaq-100 index has declined approximately 3% since the beginning of the year, lagging behind the S&P 500 index, which has remained largely stable. However, leading software-as-a-service (SaaS) companies are experiencing particularly harsh declines.

Through the current year, Microsoft has dropped 16%, Shopify has fallen 26%, Adobe has decreased 27%, and Salesforce has plummeted 30%. The underlying cause stems from investor apprehensions that artificial intelligence (AI) could fundamentally disrupt the traditional model of enterprise software sales. Should AI technologies advance rapidly to the point of fully substituting existing software solutions, these prominent software firms could face significant risks.

Yet, there are compelling indications that this bearish trend in software stocks, fueled by AI anxieties, rests on unfounded fears. Fresh analysis from J.P. Morgan indicates that the ongoing sell-off in software shares due to AI hype is exaggerated and disproportionate.

Let us delve into the insights from J.P. Morgan’s report regarding the AI-induced downturn in the software sector and explore why the present moment might represent an attractive entry point for investors eyeing software equities.

J.P. Morgan Identifies ‘Broken Logic’ Behind AI Tech Sell-Off

Investors in technology stocks appear gripped by dual major concerns simultaneously. On one hand, there is widespread fear that AI will completely overhaul the software industry, prompting sharp declines in shares of companies such as Salesforce and Adobe. On the other hand, there is apprehension that major AI hyperscalers are pouring excessive funds into AI infrastructure, with doubts about whether these hefty capital outlays will yield anticipated returns, leading to perceptions of overvaluation in those stocks—explaining drops in names like Microsoft.

Nevertheless, these two prominent AI-related worries cannot logically coexist. A study released by J.P. Morgan Private Bank labels this inconsistency as ‘broken logic’ and asserts that the market is engaging in indiscriminate selling. If AI firms are poised to disrupt, dismantle, and supplant every software provider, then the valuations of those AI stocks ought to surge accordingly. Conversely, if AI investments prove overhyped and fail to deliver returns on their massive expenditures, then investors in traditional software firms should feel considerably less threatened by AI encroachment.

Market participants seem to be retreating from the broader technology sector without a solid rationale.

Strategic Approaches for Investing in Software Stocks Today

A separate J.P. Morgan research group, as reported by Bloomberg, has issued findings characterizing the AI-prompted software stock decline as an excessive reaction at this juncture. The report urges investors to explore opportunities in ‘AI-resilient’ software equities—those from companies best positioned to leverage AI for improving their operational processes and workflows.

An additional reasoned perspective supporting the notion that this sell-off represents an overreaction lies in the specialized nature of software providers. These companies deliver tailored solutions that deliver unique value for particular industries and applications, often built on proprietary data architectures. For the time being, general AI developers lack the capability to supplant all these distinctive competitive edges.

Consider the iShares Expanded Tech-Software Sector ETF (IGV), currently priced at $82.77, reflecting a daily change of +2.24% or $1.81. Year to date, this ETF has declined 22%, yet it has achieved an impressive average annual return of 18% over the preceding decade. With a competitive expense ratio of 0.39%—incorporating its management fee—this fund provides diversified exposure to leading software enterprises. Its portfolio features heavyweight holdings such as Microsoft, Palantir, and Applovin, among others.

For those convinced that the AI-driven decline in software stocks constitutes an irrational overreaction, the current environment could present a prime buying opportunity. This ETF offers a straightforward avenue to gain broad-based ownership across the software industry, mitigating individual stock risks while capturing sector-wide potential.