IonQ, Rigetti, D-Wave Insiders Sell $615M in Quantum Stocks Warning

Quantum Computing Captures Wall Street’s Attention

The individuals with the deepest insights into IonQ, Rigetti Computing, and D-Wave Quantum are delivering a powerful message to investors through their trading decisions. While artificial intelligence has commanded much of Wall Street’s focus over recent years, it was quantum computing companies that truly dominated discussions and market movements in 2025. By the middle of October, these pure-play quantum computing enterprises had delivered extraordinary trailing 12-month gains, spanning from a minimum of 670% up to an astonishing 6,217% for leading names like IonQ, Rigetti Computing, and D-Wave Quantum. Those investors who anticipated the revolutionary impact of quantum technology reaped massive rewards in remarkably short order.

However, history shows that explosive surges in stocks tied to emerging breakthrough technologies often come with significant pitfalls. Although clear drivers propelled these quantum computing shares to remarkable heights, a substantial cautionary indicator valued at $615 million emerges from the very people most familiar with these businesses.

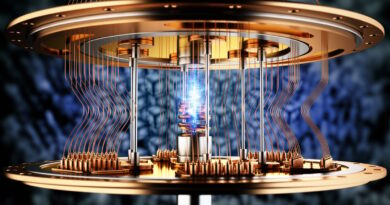

Quantum computing has burst onto the financial scene with tremendous enthusiasm from market participants. The impressive one-year performance metrics for IonQ, Rigetti Computing, and D-Wave Quantum underscore the widespread optimism surrounding the practical applications of quantum systems. Unlike traditional classical computers, quantum machines possess the unique ability to process and solve extraordinarily complex problems that conventional systems simply cannot address. Moreover, they operate at speeds that vastly outpace even the most advanced supercomputers currently available.

Among the most compelling prospective uses for quantum computing are advanced simulations of molecular interactions, which hold the promise of dramatically enhancing the development of new pharmaceuticals by boosting success rates in drug discovery processes. Additionally, quantum technology could accelerate the training and refinement phases of artificial intelligence models, enabling faster progress in AI capabilities overall.

Experts from the Boston Consulting Group project that quantum computing could generate between $450 billion and $850 billion in worldwide economic benefits by the year 2040. Similarly, insights from The Quantum Insider suggest that the total market opportunity for quantum systems might reach as high as $1 trillion by 2035. Should these projections prove even remotely accurate, the pioneering companies entering this space now stand to achieve substantial long-term success and dominance.

Key Catalysts Fueling Investor Interest

Beyond the transformative real-world applications, the investment allure of quantum computing is equally captivating. In particular, IonQ, Rigetti Computing, and D-Wave Quantum experienced sharp upward momentum in October following the release of a comprehensive report from JPMorgan Chase, America’s largest bank measured by total assets. This document outlined the bank’s $1.5 trillion Security and Resiliency Initiative, which highlighted 27 distinct sectors ripe for financing and investment over the ensuing decade, prominently featuring quantum computing as a priority area.

Furthermore, market confidence has been bolstered by the initial commercial deployments of quantum computers among some of the most prominent corporations in the stock market. A prime example is Amazon’s Braket quantum cloud platform, which provides access to hardware from IonQ, Rigetti Computing, and D-Wave Quantum. Securing contracts with high-profile clients and establishing long-term partnerships with established industry giants represents a critical milestone for these emerging players in validating their technology’s viability.

Insider Transactions Raise Eyebrows

Despite the bright prospects for quantum computing as a field, the situation appears far more precarious for the dedicated pure-play stocks that have ridden this wave to extraordinary valuations. One of the most glaring concerns stems directly from the trading patterns of company insiders at IonQ, Rigetti Computing, and D-Wave Quantum. In the securities world, insiders refer to senior executives, directors on the board, or major shareholders owning 10% or more of the company’s shares. These key figures often have access to material non-public details about the business and must report all transactions, such as option exercises or share sales, to the Securities and Exchange Commission through Form 4 filings.

Not every insider transaction carries deep implications, but in the realm of quantum computing pure-plays, the patterns revealed in these Form 4 reports are particularly telling and warrant close examination by investors.

Over the trailing 12 months concluding on February 14, 2026, the net proceeds from insider sales at these companies paint a stark picture:

- IonQ: $451.1 million in net sales

- Rigetti Computing: $45.6 million in net sales

- D-Wave Quantum: $118 million in net sales

Collectively, insiders across these top quantum computing favorites have offloaded roughly $615 million more in company shares than they have acquired during this period. It’s important to contextualize this data carefully. Many executives receive compensation primarily in the form of equity grants and stock options, leading them to sell portions of their holdings routinely—often immediately after exercising options—to settle tax obligations at federal and state levels. Insider selling can arise from various legitimate motivations, and it does not inherently signal wrongdoing or pessimism.

Conversely, when insiders choose to purchase shares outright with their own funds, it unequivocally demonstrates conviction in future appreciation, as there is no other rationale for such voluntary investment. Notably, no insiders at Rigetti Computing have made any open-market purchases over the past year. At D-Wave Quantum, the sole buy was a modest 82 shares worth $1,795 by one director. IonQ saw slightly more activity, with two directors acquiring shares valued at approximately $2.1 million in total.

Implications of Limited Buying Activity

The scarcity of insider buying suggests that those with the most intimate knowledge of these operations may not view their companies’ current stock prices as compelling entry points. These quantum computing enterprises command sky-high price-to-sales multiples, reflecting speculative fervor rather than grounded fundamentals. Compounding this, they issued billions in new shares during the previous year to secure funding for ongoing development and operations, which has the effect of diluting existing shareholders.

These firms also confront formidable historical precedents. Over the past three decades, virtually every disruptive technological leap—from the internet boom to blockchain—has weathered a dramatic correction or bubble burst during its nascent growth stages. Investors frequently exhibit excessive optimism regarding the pace of adoption and refinement for novel innovations, and quantum computing exemplifies this tendency. The sector remains firmly in its infancy regarding widespread commercialization, with full business optimization and profitability likely requiring many years of further advancement, rigorous testing, and infrastructure buildout.

The insider selling trends at IonQ, Rigetti Computing, and D-Wave Quantum serve as a potential harbinger of challenges ahead, urging caution amid the hype. While the long-term transformative power of quantum technology cannot be denied, the path for these specific stocks is fraught with elevated risks that demand careful consideration from prospective investors seeking to navigate this volatile landscape.