Impact of Dovish Fed Policy on Your Wallet

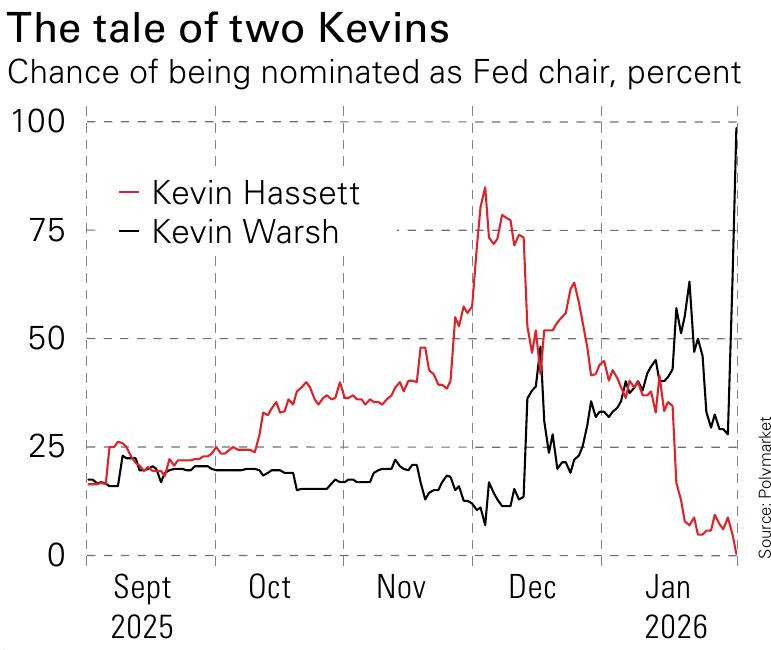

I have to confess my disappointment that Donald Trump selected the incorrect Kevin for the role of the next Federal Reserve chair. For quite some time, Kevin Hassett—who those with long-term investment recollections might remember as the writer of the notoriously optimistic book Dow 36,000—was the frontrunner. Choosing him would have undoubtedly undermined the Federal Reserve’s reputation, yet his eager advocacy for slashing interest rates would have provided considerable amusement. Unfortunately, Trump reconsidered, denying us the kind of central bank leader that fits these unusual circumstances.

Nevertheless, the notion that Kevin Warsh will emerge as a staunch advocate for higher interest rates seems unlikely, no matter his past stance at the Federal Reserve over a decade and a half ago. He seems inclined toward substantial reductions in short-term rates, though perhaps not to the extreme degree Hassett proposed. Concurrently, Warsh advocates for reducing the Fed’s extensive bond portfolio. In principle, this strategy should lead to elevated long-term yields, as the central bank steps back from absorbing large volumes of longer-maturity bonds, potentially resulting in a more pronounced yield curve. It remains uncertain how this aligns with Treasury Secretary Scott Bessent’s apparent goal of keeping long-term yields in check. Overall, the emerging scenario could prove rather perplexing for markets and investors alike.

Republicans’ Continued Respect for the Federal Reserve’s Independence

This perspective, of course, hinges on Warsh securing confirmation as chair and rallying sufficient support among Fed governors, an outcome that is far from guaranteed. Among the scant U.S. institutions that the Supreme Court and Republican senators appear committed to protecting from presidential overreach is the modern central banking apparatus, often likened to a ritualistic practice. Trump has pushed boundaries aggressively across numerous domains, yet granting him unchecked influence over the cadre of technocrats tasked with steering a $30 trillion economy through interest rate adjustments crosses an unacceptable line for many. That said, historical patterns indicate he will likely achieve much of his objectives regardless. Should that occur, Warsh’s articulated positions align well with our current asset-allocation strategy. We continue to view longer-term bonds as inadequate in rewarding the risks posed by rising yields and escalating inflation—not only in the U.S. but also in the UK and other regions—prompting us to maintain our preference for short-term bonds.

A key element of our defense against potential missteps by central banks is our 10% portfolio allocation to gold. I question whether the sharp decline in gold prices late last week was truly linked to Warsh’s prospective appointment, despite such claims circulating widely. Precious metals had surged dramatically in the prior week, exhibiting unmistakable signs of speculative frenzy, making a correction inevitable. Meanwhile, dramatic fluctuations in shares of data and digital firms—potentially influenced or not by artificial intelligence developments—underscore a jittery and unpredictable market environment.

We are holding steady on our current positions without alterations, but long-term gold holders might notice it now constitutes a significantly larger portion of their overall portfolio than planned. If your exposure has become disproportionately heavy, consider paring it back toward your intended allocation. In our case, we will address this during our standard end-of-tax-year rebalancing process.