Guggenheim Municipal Income Fund Q4 2025 Review

Performance Review

The Guggenheim Municipal Income Fund, specifically the Institutional Class shares under the ticker GIJIX, delivered a solid return of 2.14 percent during the fourth quarter of 2025. This performance notably surpassed its primary benchmark, the Bloomberg Municipal Bond Index, by a margin of 0.58 percent. Such outperformance underscores the fund’s effective management strategies in navigating the municipal bond market landscape.

In examining the key contributors to this success, certain sectors within the portfolio stood out prominently. Bonds issued by school districts played a significant role in boosting overall returns, reflecting the stability and reliability of these obligations backed by educational institutions. Similarly, housing-related bonds provided positive momentum, benefiting from steady demand and favorable economic conditions in residential financing. General purpose bonds, often tied to broad governmental functions, also added to the gains, demonstrating resilience amid varying market pressures.

On the other hand, not all sectors performed equally well. Transportation bonds emerged as a notable detractor from performance during this period. Factors such as infrastructure funding uncertainties and shifting priorities in public spending likely weighed on this category, highlighting the importance of selective positioning in volatile segments.

Market Outlook and Positioning Strategy

Looking at the current valuation environment in the municipal bond market, we maintain a cautious yet opportunistic stance. At present levels, it is essential for investors to adopt a more discerning approach when it comes to credit selection. This means prioritizing issuers with strong fundamentals, robust revenue streams, and minimal default risk. Duration positioning also warrants careful consideration, as interest rate expectations continue to influence bond pricing dynamics.

The fund’s forward-looking strategy emphasizes high-coupon bonds that offer attractive yields while being underpinned by solid collateral and protective covenants. These securities provide a buffer against potential rate fluctuations and credit spread widening. Furthermore, opportunities are being explored in sectors such as higher education and healthcare, where temporary mispricings have created entry points for value-oriented investors. These areas, despite facing short-term headwinds like enrollment pressures or reimbursement challenges, possess long-term structural advantages that could drive recovery and appreciation.

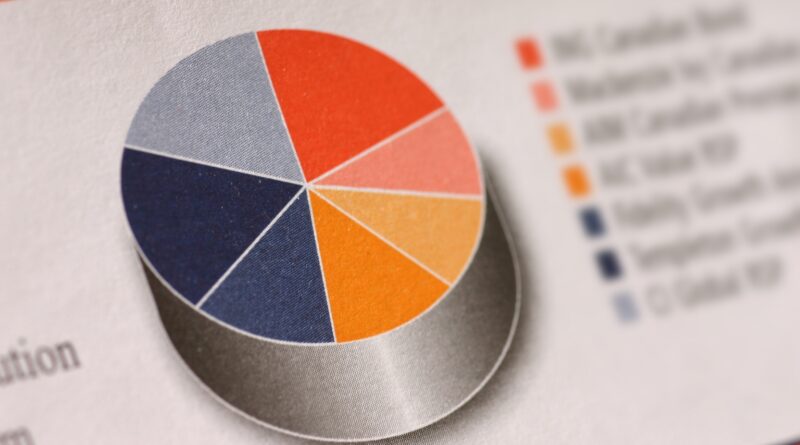

Sector and Geographic Contributors

Delving deeper into performance drivers, school district bonds not only led among large sector allocations but also benefited from specific state-level dynamics. Issuances from Tennessee and Oregon proved particularly rewarding, likely due to favorable fiscal policies, population growth supporting tax bases, and efficient budget management in these regions. These examples illustrate how geographic diversification can enhance returns within the municipal sector.

Conversely, challenges in transportation bonds were compounded by exposures in states like New York and Texas. In New York, complex funding mechanisms for transit projects and political debates may have introduced volatility. Texas faced hurdles possibly related to energy sector linkages and budget reallocations away from infrastructure. These detractors serve as a reminder of the risks inherent in concentrated bets on cyclical sectors.

Strategic Insights for Investors

In summary, the fourth quarter results for GIJIX reflect a balanced approach to municipal bond investing, with outperformance rooted in astute sector allocations. As we move forward, the fund remains focused on selectivity in credits and durations to capitalize on market inefficiencies. Investors seeking income with tax advantages in the municipal space may find value in this disciplined methodology, especially amid evolving economic conditions.

This positioning is designed to weather potential headwinds such as rising rates or credit concerns while positioning for upside in undervalued areas. By favoring well-protected, high-coupon instruments and scouting opportunities in education and healthcare, the portfolio aims to deliver consistent risk-adjusted returns. Market participants are encouraged to monitor these themes closely, as municipal bonds continue to offer compelling attributes for diversified fixed-income strategies.