Electric Micromobility Growth in Southeast Asia and Africa

The fundamental advantage of electric vehicles has always been their significantly reduced environmental impact when compared to traditional vehicles powered by fossil fuels. However, as detailed by Charlie Colasurdo and Xiangming Chen, real-world examples reveal even greater advantages, particularly for communities where reliable transportation plays a vital role in daily life.

Global Expansion of Electric Micromobility

Electric micromobility solutions are experiencing rapid worldwide adoption, fueled in large part by China’s dominant position in both domestic implementation and global manufacturing of electric vehicles, where BYD holds a leading role (Huang and Chen, 2025a). This expansion, spearheaded by China, contributes to decreased emissions, improved air quality, and reduced noise levels in urban areas. A key question arises: how does this development integrate into enhancing transportation systems to meet the escalating traffic and mobility requirements of fast-expanding, densely congested megacities in the global South?

This analysis explores this issue through a detailed comparative examination of two-wheeler and three-wheeler micromobility implementations in Bangkok, Thailand, and several prominent African urban centers. In megacities across the global South, electric two- and three-wheelers have become essential components of innovative mobility frameworks, supported by affordable battery technology, digital applications, and shared economy models involving gig economy labor and ride-sharing services. These vehicles represent a critical element in micromobility networks that are tailored to the unique spatial layouts and infrastructure characteristics of their host cities.

In this piece, we conduct an in-depth comparison of the ways in which electric motorcycles and tricycles are transforming the transportation environments of megacities in the global South. While highlighting the substantial environmental, economic, and societal advantages offered by this form of electric micromobility, we also shed light on the critical challenges related to financing, infrastructure development, and operational efficiency that must be overcome to ensure the sustained expansion and seamless operation of these electric two- and three-wheeled vehicles.

Bangkok’s Expanding Public Transportation Network

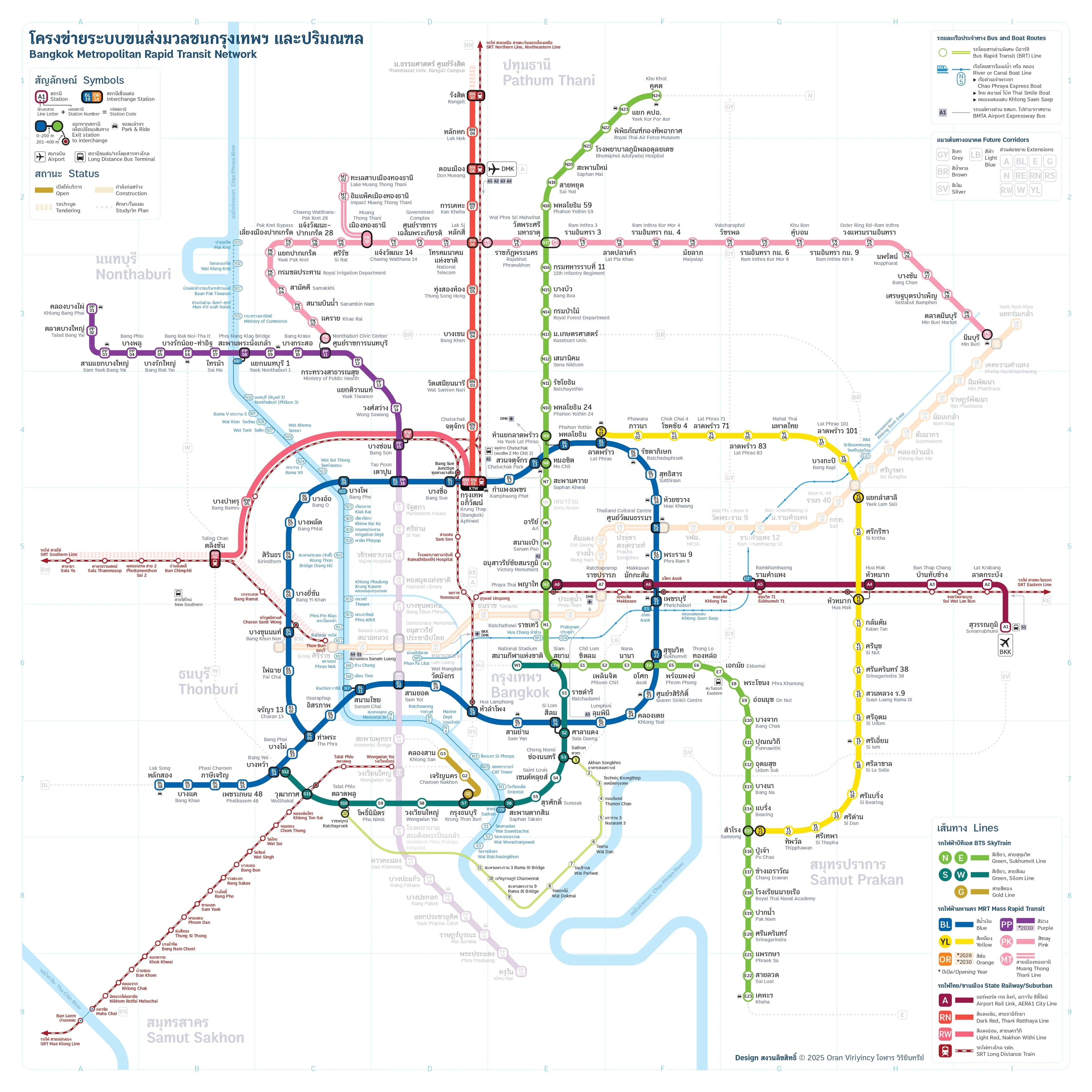

Bangkok, Thailand, home to more than 10 million residents and recognized as one of the planet’s most popular tourist destinations with 32.4 million visitors in 2024, grapples with severe traffic congestion and high levels of particulate matter pollution (Mansel, 2024). In response, the metropolis has committed substantial resources to developing an extensive public transit infrastructure. The introduction of the elevated BTS SkyTrain in 1999 marked the beginning of this transformation, which has since evolved to include two electrified commuter rail lines, an airport rail connection, two MRT subway lines, two monorail systems, three SkyTrain lines, and a dedicated Bus Rapid Transit corridor (Lesmes, 2018). Future developments are ambitious, encompassing numerous high-speed rail connections linking the city’s new central station to regions in Eastern and Northeastern Thailand, various line extensions, and an additional MRT line currently in progress. The 2024 Mass Rapid Transit Master Plan (M-MAP 2) outlines 11 new electric train routes spanning 163 kilometers, with initial completions slated for 2028-2029 (The Nation, 2024).

The ongoing growth of Bangkok’s rail infrastructure has effectively linked high-traffic tourist spots in the historic Phra Nakhon District—often called the Old Town—with suburban areas in the eastern and northern parts of the city, as well as locations across the Chao Phraya River in Thonburi, all connected to the bustling Central Business District. As transit coverage extends to new neighborhoods, addressing first- and last-mile connectivity emerges as the primary concern. Bangkok’s comprehensive mobility landscape incorporates a diverse array of options, ranging from motorcycle taxis and the famous Tuk-Tuks to river ferries, canal boats, express water services, and conventional buses. Nevertheless, commuters continue to encounter hurdles in covering the final distances from transit stops to residences, workplaces, and educational institutions, exacerbated by insufficient pedestrian pathways, sweltering temperatures, and a seasonal monsoon climate. Although the uptake of electric cars, trucks, and buses is on the rise, the city confronts a worsening air quality crisis that has periodically forced the closure of schools and businesses.

Electric Tuk-Tuks Revolutionizing Last-Mile Travel

A silent transformation driven by technology is taking place amid Bangkok’s bustling roadways, powered by cutting-edge vehicle engineering, smartphone applications, and escalating needs for efficient last-mile transportation solutions.

The widespread availability of ride-hailing platforms such as Grab and Bolt, combined with the proliferation of battery electric vehicles and the proliferation of rapid transit systems, has opened a prime window for micromobility innovations to resolve the persistent last-mile dilemma—that crucial link between transit hubs and final destinations like homes, schools, and offices. In Bangkok, the traditional gasoline-fueled Tuk-Tuks are being augmented by spacious, low-noise electric variants operated by MuvMi, a app-based ride-hailing provider akin to Grab. Hundreds of these MuvMi Tuk-Tuks now operate across 11 neighborhoods in Bangkok, completing thousands of journeys throughout 2024. They have become a familiar sight near university grounds, subway stations, and tight alleyways, signaling a tech-driven renaissance for Tuk-Tuks on the city’s jam-packed streets, harnessed through advanced design, app integration, and surging demand for short-distance connectivity.

The parent entity behind MuvMi, Urban Mobility Tech Co. Ltd., came into existence in 2016 under the leadership of founders Krisada Kritayakirana, Pipat Tangsiripaisan, Supapong Kitiwattanasak, and Metha Jeeradit. The MuvMi EV Tuk-Tuk app debuted in 2018, enabling users to summon a bespoke three-wheeled vehicle that surpasses the conventional petrol Tuk-Tuk in size and capacity, accommodating up to seven passengers including the operator. By 2022, daily passenger trips ranged from 2,000 to 4,000 across five operational zones. Expansion accelerated in 2023 to 10 areas, reaching about 20,000 daily trips in 2024, and climbing to 28,000-30,000 by October 2025 (Sangveraphunsiri, 2025).

MuvMi’s operational footprint spans roughly 100 to 150 square kilometers, featuring approximately 8,000 designated pick-up and drop-off hop points throughout Bangkok. Distinct from standard Tuk-Tuk rides or conventional ride-hailing, passengers are restricted to travel between hop points within a single service zone. Moreover, it operates genuinely as a ride-sharing initiative, potentially detouring to accommodate additional riders en route in a shared journey format.

As of October 2025, MuvMi boasts around 700 daily active EV Tuk-Tuk drivers managing 600 to 700 vehicles each day. The complete fleet totals 800 units, with surplus vehicles allocated to alternative income sources like private rentals (Sangveraphunsiri, 2025). Fares for the ride-sharing service remain accessible, starting at 10 Thai Baht (equivalent to 0.32 USD), partly offset by revenues from ancillary businesses. This pricing structure maintains competitiveness against motorcycle taxis and legacy petrol Tuk-Tuks, thereby broadening user accessibility.

Evolving with Urban Dynamics

MuvMi conducts biannual reviews of its service zones; the operations team meticulously analyzes maps and adjusts boundaries to incorporate nearby hop points while densifying them along zone peripheries to stimulate higher utilization. As Bangkok advances its Metropolitan Rapid Transit expansions, MuvMi strategizes to prioritize connectivity for stations along the high-volume east-west MRT Orange Line (28 stations) and the MRT Purple Line’s southern extension (17 stations), both slated for 2030 operations (Sangveraphunsiri, 2025). The company intends to bridge service voids along these corridors slicing through the city’s most gridlocked core. For lower-capacity monorails like the Pink and Yellow Lines, demand assessments are underway for potential route alignments.

Conversely, MuvMi influences user behaviors; transitioning riders from Grab automobiles and motorcycle taxis to EV Tuk-Tuks presents the service’s toughest marketing hurdle. Historically dependent on organic referrals, the company is now collaborating with the Bangkok Metropolitan Administration on promotional efforts tied to the city’s annual car-free day in September 2025, urging those in service areas to leverage MRT and BTS facilities.

The archetypal MuvMi patron is a female professional aged 20-40 working in central districts. Trip data indicates 30-40 percent initiate or conclude at metro stations, underscoring primary use for work commutes and transit handoffs (Sangveraphunsiri, 2025). The remaining 60 percent encompass outings for meals, or group neighborhood travels—such as in Ari—where car-free options prove impractical. MuvMi estimates half its rides supplant prior walking, motorbike, or taxi trips, while the other half enables entirely new journeys previously unfeasible.

Growth into Regional Centers

Tuk-Tuks and varied micromobility variants proliferate across Thailand’s urban landscape, including key tourist locales like Phuket and Chiang Mai. In 2019, Grab initiated GrabTukTuk Electric in Chiang Mai alongside Nakorn Lanna Cooperative, targeting the phase-out of 450 LPG Tuk-Tuks (Karnjanatawe, 2019). Additional entrants include PPS Utility Co. Ltd., which rolled out the tourism-oriented LoMo platform with EV Tuk-Tuks by 2023, aspiring to 100,000 app downloads within the first year.

Opting against direct fleet deployment elsewhere, MuvMi pursues alliances with regional operators to elevate service standards and bolster public transport perceptions. In Chiang Mai, partnerships with songthaews aim to secure their viability financially, eschewing expensive EV Tuk-Tuk rollouts. This measured outreach beyond Bangkok underscores electric Tuk-Tuks’ viability as cost-effective, eco-friendly multipurpose transport in Thailand’s secondary Southeast Asian hubs.

Electric Two- and Three-Wheelers Transforming African Urban Mobility

Parallel to the rising prominence of electric three-wheelers in Bangkok and prospective Southeast Asian peers, electric two- and three-wheeled motorcycles are carving out a dynamic, multifaceted niche in numerous African megacities and extending into rural peripheries, with strong growth trajectories ahead. This e-bike surge builds upon decades of petrol motorcycles’ entrenched popularity across Africa. These versatile machines facilitate private passenger transport, serve as public taxi services, and dominate goods and food delivery sectors (see photo 2). In Kenya, for instance, roughly five million individuals derive livelihoods from motorbikes, equating to one in ten residents (Huang, Lei and Ji, 2025).

Contrasting Bangkok’s mature public transit relegating electric Tuk-Tuks to niche last-mile, side-street, and peripheral roles, African cities’ sparse bus networks and limited paved roadways elevate motorbikes—including three-wheelers—for primary people and cargo movement, particularly navigating urban fringes and corners where informal transport dominates over 70 percent of trips. In principal cities of Mali, Burkina Faso, and akin nations, two- and three-wheelers constitute nearly 80 percent of vehicles, with petrol three-wheelers handling about 80 percent of short-haul logistics (CIEG, 2025).

China’s Pivotal Role in African Markets

Given China’s status as Africa’s top trading partner since 2009, its influx into the continent’s vast motorcycle sector was anticipated. Indeed, 2024 saw China dispatch 3.8 million assembled motorcycles valued at $282 million to Africa—a 21 percent annual uptick (Huang, Lei and Ji, 2025). First-quarter 2025 exports hit 1.2 million units, Africa’s second-largest destination globally, surging 63 percent from 2024 (China Industry Net, 2025). Chongqing, China’s motorcycle manufacturing epicenter, led with $361 million in 2024 African exports, rising 19.7 percent and comprising 15-20 percent of national totals (Wang, 2025).

Among Chinese exports, electric two- and three-wheelers are capturing greater market share owing to their superior suitability for African terrains. Petrol variants notoriously contribute heavily to ground-level pollution; in Nairobi, motorbike exhausts drive 40 percent of total urban emissions. In Tanzania, electric three-wheelers slash fuel expenses to one-sixth of petrol equivalents amid volatile high prices, dropping daily delivery costs from $12 to $1 (CIEG, 2025).

Advanced Chinese Innovations for African Needs

Capitolizing on surging demand for electric two- and three-wheelers, Chinese firms are deploying adaptations for Africa’s rapid urbanization, gridlock, subpar roads, and deficient last-mile links. A Chongqing tire manufacturer, exporting for local bikes and versed in rugged megacity demands, has engineered tire lines resilient to African potholes, debris, rough patches, and intense heat, pursuing enduring importer pacts.

TECNO, under Shenzhen-based Transsion—a hardware innovation hub dubbed China’s Silicon Valley—exemplifies this trend. Targeting Africa since 2008, TECNO commands over 50 percent smartphone share. In 2023, it launched TankVolt three-wheelers, swiftly expanding to additional electric two- and three-wheeler lines.

TECNO’s REVOO sub-brand offers entry-level models from $420, mirroring its budget phone strategy, securing a 5,000-unit Nigerian government order and topping African EV sales (CIEG, 2025). Crucially, BaaS (battery-as-a-service) lets buyers acquire vehicles sans battery, subscribing separately to ease upfront costs.

Broadening Reach and Local Empowerment

Chinese engagement has propelled Africa’s e-micromobility surge, spawning avenues for local firms to compete and collaborate. Kenya-headquartered Spiro, established 2019, inked a 2022 deal for 50,000 Hangzhou-sourced e-motorbikes. 2023 brought $63 million loans from France’s Société Générale and UK’s GuarantCo for BaaS stations and fleet growth in Kenya/Uganda. A 2024 $50 million African Import/Export Bank loan facilitated Cameroon, Morocco entry, plus Tanzania in 2025 alongside $100 million capital raise (Tailun, 2025).

Spiro thrives via BaaS: its CEO notes, African drivers log 10-12 hours daily over 150-200 km, gaining fuel savings but hindered by charging downtime. With batteries at 30-40 percent vehicle cost, BaaS subscriptions enable affordable access (Tailun, 2025). In Uganda’s Kampala, drivers swap depleted batteries via TECNO phones at stations, drawing boda-boda operators despite e-bikes’ 10 percent taxi share. Scaling could curb emissions in a pollution hotspot.

Spiro’s model integrates assembly in Kenya, Uganda, Rwanda, Nigeria using Chinese CKDs. Its Kenyan hub now produces traction motors; local sourcing for plastics, helmets, brakes hits 30-40 percent, targeting 70 percent soon via Chinese tech transfers (Tailun, 2025).

Key Takeaways

In Southeast Asia and Africa alike, electric vehicle micromobility ventures harness smartphone ubiquity and battery advancements to fulfill varied transit demands. Bangkok’s sturdy rail backbone nurtures adaptable last-mile EV Tuk-Tuk sharing attuned to commuter fluxes. African e-motorbikes accelerate across taxis, hauling, deliveries, bridging vast transit voids in sprawling, clogged metros. China’s Thailand footprint features BYD’s nearby plant (Huang and Chen, 2025b), while smaller entities drive Africa’s via exports, CKDs, local builds, tech sharing.

These examples underscore EV micromobility’s concrete gains: slashed fuel bills, mitigated pollution, enabled swift trips infeasible before. In tropical, overcrowded, booming cities reliant on two/three-wheelers, it boosts livability and paves electrification paths. Its trajectory promises enduring progress.