Dave Ramsey’s Urgent Debt Payoff Plan for Over-50s

Transitioning from employment to retirement brings a mix of excitement and apprehension, particularly when lingering debts remain unsettled. Those entering retirement face escalating living expenses and the challenge of stretching their savings, where regular debt obligations can substantially diminish available funds.

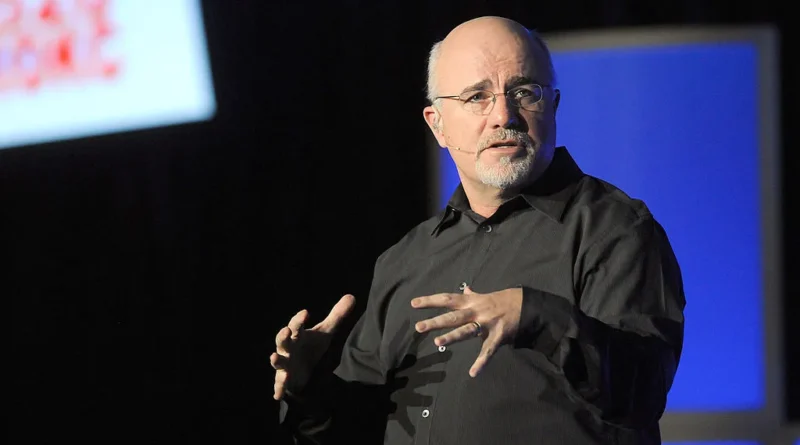

However, it’s never too late to tackle debt aggressively, especially high-interest varieties such as credit card balances. Renowned personal finance expert Dave Ramsey has shared extensive guidance over the years on achieving a debt-free status, and individuals over 50 approaching retirement can apply his proven strategies to better position themselves for the future ahead.

Adjust your lifestyle

The foremost step involves halting any new borrowing entirely. This often requires reshaping daily habits to eliminate dependence on credit for everyday acquisitions. For instance, if frequent restaurant meals lead to mounting credit card charges that prove difficult to clear monthly, shifting to preparing meals at home and planning ahead with batch cooking can make a significant difference.

Beyond preventing new debt, focus on clearing existing obligations, which might necessitate additional habit modifications. Consider exchanging an extravagant annual getaway for a modest weekend retreat at a local destination during the low season. These choices free up funds to accelerate debt reduction. Thoroughly examine all discretionary expenditures to identify potential cuts. Then, scrutinize essential outlays like food shopping, fuel, and utility bills, exploring options such as comparing providers or bargaining for better rates to lower overall costs.

Lifestyle shifts extend beyond mere restrictions; they can include proactive income boosts. Taking on a side gig or opting for semi-retirement through part-time work for several years prior to full retirement provides extra resources. For those in their 50s, time for investment growth through compounding is limited compared to younger individuals, heightening the need for swift and decisive debt elimination.

Build a budget

Establishing a budget is essential for monitoring spending patterns and preventing excesses. Options include utilizing dedicated applications like Monarch or YNAB, crafting a custom spreadsheet, or maintaining a handwritten ledger. Such tools enable precise allocation of funds toward debt repayment while curbing non-essential purchases.

Financial professionals consistently advise maintaining an emergency reserve covering three to six months of living costs. This safeguard ensures that unforeseen expenses do not force a return to borrowing, thereby avoiding the debt cycle altogether.

Choose a debt strategy

With foundations in place, select an approach to systematically eliminate debts. The debt avalanche method prioritizes balances with the highest interest rates first, ultimately reducing total interest paid over time. Adherents typically target credit card debts due to their elevated costs relative to other loans, progressing to the next highest rate, then the following, and continuing downward.

Alternatively, the debt snowball technique focuses on clearing the smallest outstanding balance initially, irrespective of its interest rate. This builds psychological wins and momentum, fostering the discipline required to persist with the repayment plan through to completion.

Dave Ramsey particularly champions the snowball method for its motivational benefits, emphasizing quick victories to sustain long-term commitment. Both strategies demand consistent minimum payments on all debts while directing surplus funds to the designated priority target. Combining these with rigorous budgeting and lifestyle tweaks empowers those over 50 to reclaim financial control swiftly. As retirement looms, shedding debt burdens enhances security, allowing fixed incomes to cover necessities without strain. Ramsey’s principles underscore that proactive steps today pave the way for a more liberated tomorrow, proving age is no obstacle to financial renewal.