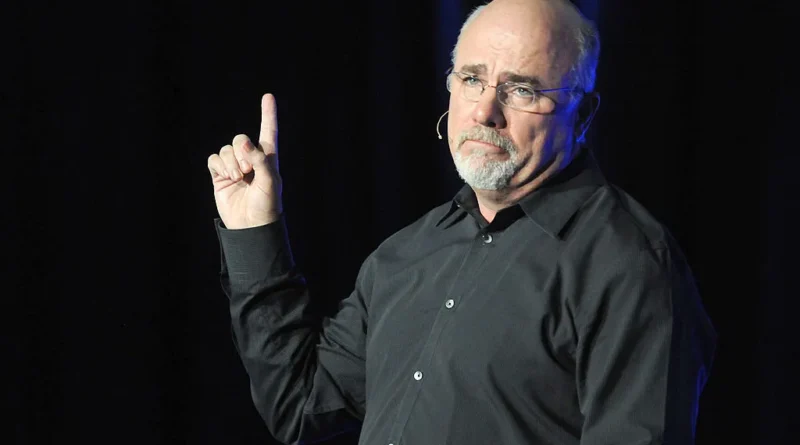

Dave Ramsey’s 3 Costly Financial Errors to Avoid After 50

Having a solid financial strategy is essential at every life stage, but it becomes particularly vital as you approach retirement. Ensuring your finances are well-organized during this period is key, and steering clear of common pitfalls in financial planning is crucial to safeguarding your future objectives.

Retiring While Carrying Debt

Financial expert Dave Ramsey strongly cautions against exiting the workforce with lingering debts, viewing it as a potentially devastating error. He urges individuals to eliminate their mortgage, automobile loans, credit card balances, and any other outstanding obligations prior to retirement. Even if a substantial savings cushion makes debt seem controllable, an unexpected medical emergency or other unforeseen cost could easily derail your payments, leading to delinquency and financial stress.

Ramsey advocates for an aggressive approach to debt repayment in the lead-up to retirement. This not only frees you from burdensome payments but also allows your savings and investments additional time to grow. Those extra years of compounding returns can significantly enhance your financial flexibility once you retire, enabling you to live comfortably without constant worry and pursue the activities and experiences that bring you joy.

Neglecting to Create and Follow a Budget

Establishing and adhering to a budget is a cornerstone of sound financial management, especially for those eyeing retirement. This practice ensures your expenditures align with your income and long-term aspirations, regardless of your age, and plays a pivotal role in amassing the necessary savings for your post-career life.

Without a budget, it’s all too easy to overspend on major categories like housing or vehicles. Many fall into the trap of purchasing oversized homes beyond their means or splurging on high-end luxury cars when a reliable used option would better serve their retirement objectives.

In Ramsey’s perspective, a budget serves as a framework for intentional spending rather than a restrictive measure. After prioritizing essential bills, debt reduction, and investments, the leftover funds become available for discretionary enjoyment without any accompanying guilt or regret.

Over-Reliance on Social Security Benefits

While Social Security acts as a valuable safety net in retirement, it often falls short of covering all necessary living expenses on its own. Numerous retirees underestimate their ongoing monthly outlays, only to discover that their Social Security checks barely scratch the surface of basic needs. Additionally, claiming benefits at the earliest eligible age results in permanently lower payments compared to delaying until later, which boosts the monthly amount received.

Ramsey consistently advises against treating Social Security as the primary pillar of your retirement income strategy. With escalating living costs—particularly in healthcare—it’s imperative to cultivate a robust nest egg capable of funding daily expenses and cherished retirement pursuits, such as travel or hobbies. Positioning Social Security as a supplemental resource rather than the foundation allows for greater financial security and lifestyle freedom.

Prospective retirees must shift their mindset beyond merely determining the timing of retirement. They should delve into the mechanics of how to retire effectively, meticulously calculating the total funds required to thrive amid rising inflation and expenses. By heeding Ramsey’s guidance and avoiding these pitfalls, individuals over 50 can position themselves for a stable, fulfilling retirement unmarred by financial hardships.