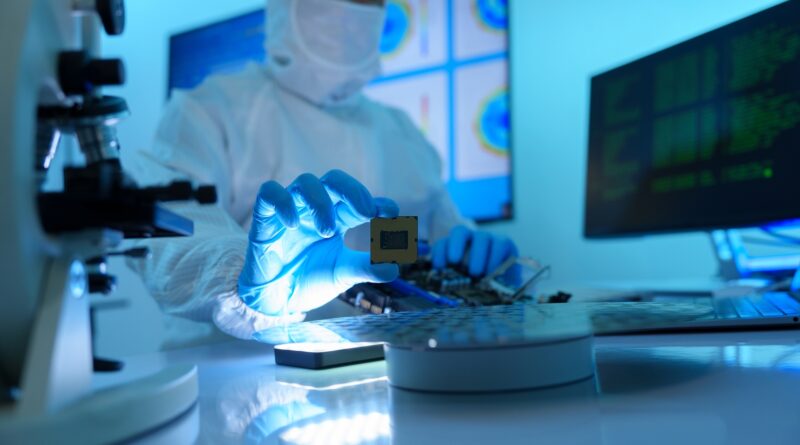

Cohu Bearish Outlook Holds After Q4 Earnings Miss

Summary of Key Concerns

Cohu, Inc. (NASDAQ: COHU) continues to carry a bearish rating stemming from ongoing operational deficits, the introduction of new convertible debt, and concerning technical indicators across various timeframes. Even though the company experienced a notable 34% increase in recurring bookings and achieved 60% recurring revenue during the fourth quarter, it still posted negative earnings results and fell short of analyst expectations for the bottom line. Operating margins have shown no meaningful improvement despite revenue expansion exceeding 12%, as gross margins faced downward pressure from exceptional inventory-related charges alongside elevated selling, general, and administrative expenses. The freshly issued $290 million in convertible debt introduces substantial dilution risks and potential for further price declines, while extended-term technical patterns solidly affirm that COHU stock persists in a pronounced bear market phase.

Recent Stock Performance Context

In fairness to Cohu, Inc., the company’s shares have delivered strong performance over the past approximately 10 months, achieving significant appreciation following a plunge to below $13 per share back in March of the previous year. This recovery has been impressive, yet our prior assessments of Cohu have consistently highlighted underlying vulnerabilities that temper enthusiasm for sustained upside. The recent fourth-quarter earnings disclosure, while containing some positive elements in booking trends, ultimately reinforces the structural challenges plaguing the business model and financial health.

Dissecting Q4 Financial Results

Delving deeper into the quarterly outcomes, Cohu’s management reported a blend of metrics that, on the surface, suggest pockets of resilience amid a tough semiconductor testing equipment landscape. Recurring revenue streams, which now constitute a majority of total revenue at 60%, represent a strategic shift toward more predictable income sources—a development that investors should monitor closely for future stability. The 34% year-over-year surge in recurring bookings indicates potential demand stickiness from key customers in the semiconductor sector, possibly signaling early recovery signs in end-market applications like automotive and consumer electronics.

However, these bright spots are overshadowed by persistent profitability issues. Negative earnings per share not only disappointed Wall Street consensus but also highlighted the company’s inability to convert topline growth into bottom-line gains. Revenue increased by more than 12% period-over-period, a commendable feat in a cyclical industry prone to volatility, yet this expansion failed to bolster operating margins meaningfully. Gross margin compression stemmed primarily from one-off inventory write-downs, which management attributed to excess capacity adjustments in response to fluctuating customer orders—a common but painful occurrence in this space.

Cost Structure and Efficiency Challenges

Compounding the margin pressures are persistently high SG&A costs, which remain a drag on overall efficiency. These expenses, encompassing sales efforts, marketing initiatives, and administrative overhead, have not scaled down in tandem with operational demands, raising questions about cost discipline at the executive level. For a company navigating a competitive arena dominated by larger peers with deeper pockets, such inefficiencies could erode competitive positioning over time, particularly if industry-wide demand softens further.

Debt Issuance and Dilution Risks

A particularly worrisome development post-earnings is the announcement of a $290 million convertible debt offering. While this capital raise provides liquidity for general corporate purposes—including potential investments in R&D or capacity expansion—it comes at the cost of heightened dilution risk for existing shareholders. Convertible notes, by design, offer bondholders the option to convert into equity at predetermined terms, often at prices below current market levels if the stock underperforms. In COHU’s case, this structure amplifies downside exposure, as conversion events could flood the market with new shares, exerting downward pressure on the stock price during periods of weakness.

Technical Analysis Reinforcing Bearish View

From a charting perspective, COHU’s price action remains mired in bear market territory across multiple time horizons. Long-term downtrends persist, with key resistance levels capping upside attempts and support zones repeatedly breached. Moving averages, both simple and exponential, continue to slope negatively, while momentum oscillators like RSI and MACD flash overbought warnings on short-term rallies but fail to sustain bullish divergences. Volume patterns during recent pullbacks suggest institutional distribution rather than accumulation, further validating caution for momentum traders and position holders alike.

Strategic Outlook and Investor Implications

Looking ahead, Cohu’s fortunes hinge on broader semiconductor cycle dynamics, including AI-driven demand for advanced testing solutions and normalization in memory chip production. While recurring revenue growth offers a buffer, the combination of operational losses, margin stagnation, debt overhang, and technical fragility justifies maintaining a bearish stance. Investors contemplating entry should await clearer signs of earnings inflection, such as sustained positive EPS, margin expansion, and debt reduction progress. Until then, risk management through tight stops and position sizing remains paramount in this high-volatility name.