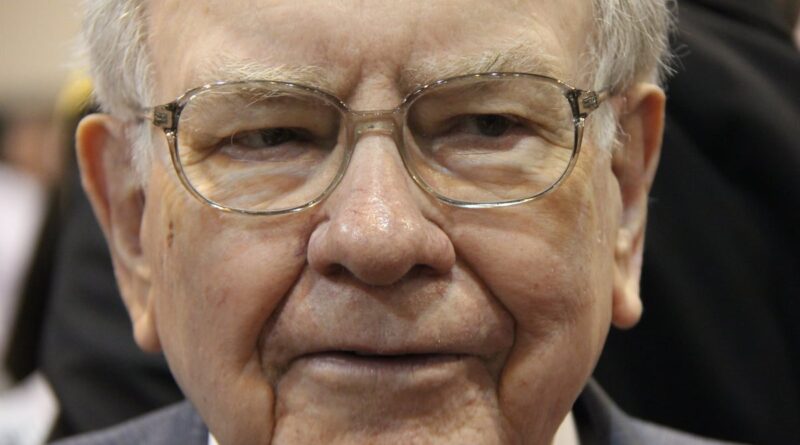

Buffett’s Last Moves: Sells Amazon, Apple, BofA; Buys NYT Stock Pre-Retirement

The Oracle of Omaha’s Final Quarter as Berkshire Hathaway CEO

Quarterly Form 13F filings submitted to the Securities and Exchange Commission serve as invaluable tools for investors seeking to monitor the buying and selling decisions of Wall Street’s most astute investment professionals. These documents offer a detailed overview of portfolio adjustments made by leading money managers over the preceding three months, providing critical insights into their strategies and convictions.

The most recent batch of 13F reports includes the concluding trading actions from Berkshire Hathaway under Warren Buffett, who stepped down as CEO on December 31, 2025. Known widely as the Oracle of Omaha, Buffett concluded his remarkable leadership tenure by directing substantial divestitures in prominent holdings such as Amazon, Apple, and Bank of America, while simultaneously introducing a fresh $352 million investment into Berkshire’s equity positions.

Throughout his final quarter at the helm, Buffett maintained a consistent pattern of net selling activity. According to Berkshire Hathaway’s latest 13F disclosure, the company offloaded more equities than it acquired, marking the 13th consecutive quarter of such behavior dating back to the start of the fourth quarter in 2022. This sustained approach to capital allocation underscores Buffett’s disciplined philosophy, particularly as he approached the end of his active management role.

Major Divestitures in Key Portfolio Holdings

In the fourth quarter of 2025, Berkshire Hathaway executed significant reductions across several high-profile investments under Buffett’s oversight. The portfolio adjustments included the complete elimination of nearly all remaining shares in Amazon, a massive trimming of its longtime largest holding in Apple, and a substantial cutback in its longstanding position in Bank of America.

- Berkshire sold 7,724,000 shares of Amazon, reducing its stake by an impressive 77 percent from prior levels.

- The company divested 10,294,956 shares of Apple, contributing to an overall 75 percent decrease in that position since the end of September 2023.

- A whopping 50,774,078 shares of Bank of America were liquidated, representing a 50 percent reduction from mid-2024 holdings.

These transactions reflect a deliberate strategy to rebalance the portfolio amid evolving market conditions. While various factors may have influenced these decisions—including potential tax considerations related to historically low peak marginal corporate income tax rates—the predominant driver appears to be concerns over current valuations. Buffett has long emphasized purchasing securities at prices that incorporate an adequate margin of safety, and these sales align with that timeless principle.

Valuation Concerns Driving the Selling Decisions

A closer examination of the valuation metrics for these divested holdings reveals why Buffett and his team may have deemed them less attractive at prevailing prices. Take Apple, for example: when Berkshire first established its position in the iPhone maker during the first quarter of 2016, the stock changed hands at a price-to-earnings ratio in the low-to-mid teens, offering compelling value relative to its earnings power. Fast forward to today, after periods of decelerating growth in physical device sales, Apple’s trailing 12-month P/E ratio has expanded significantly to 33, reflecting premium pricing that demands flawless execution to justify.

Bank of America presents a parallel narrative. Berkshire’s initial $5 billion preferred stock investment in the summer of 2011 came at a time when the bank’s common shares traded at a deep 62 percent discount to book value, presenting a classic value opportunity. Currently, those same shares command a 37 percent premium to book value, a stark reversal that diminishes the intrinsic appeal for value-oriented investors like Buffett.

Amazon, meanwhile, has rarely aligned with traditional measures of affordability. Even though the stock may appear relatively inexpensive when benchmarked against longer-term consensus cash flow projections for 2027, Buffett has consistently expressed caution toward equities sporting elevated multiples. His track record demonstrates a preference for businesses trading at discounts that provide substantial buffers against downside risk.

A Bold New Investment to Cap Buffett’s Tenure

Despite the extensive selling activity, Buffett did not conclude his time as CEO without making meaningful purchases. Among the modest additions to existing positions, one transaction towers above the rest in significance: Berkshire Hathaway acquired 5,065,744 shares of The New York Times Co., valued at approximately $352 million as of December 31, 2025. This brand-new stake represents a noteworthy departure from the net selling trend and highlights Buffett’s enduring eye for quality businesses.

Buffett has consistently gravitated toward companies possessing powerful, trusted brands that enjoy durable competitive advantages. The New York Times exemplifies this archetype, boasting a globally recognized name synonymous with journalistic integrity. Complementing this brand strength are shareholder-friendly policies, including a reliable dividend payout and ongoing share repurchase programs that enhance per-share value over time.

Strengths Underpinning The New York Times Investment Thesis

The investment rationale extends beyond brand equity to robust operational fundamentals. Digital subscription revenue continues its impressive trajectory, reaching 12.78 million paid digital-only subscribers by the end of the fourth quarter. This growth stems from effective pricing strategies that have elevated average revenue per user, coupled with double-digit expansion in digital advertising income.

These dynamics position The New York Times as a standout performer in the media landscape, demonstrating resilience amid industry headwinds. Management’s ability to monetize its content across multiple channels while maintaining subscriber loyalty underscores the company’s competitive moat and long-term potential.

- Strong pricing power driving higher revenue per subscriber.

- Accelerating digital ad sales providing diversified income streams.

- Consistent execution across a transitioning media environment.

One potential caveat warranting attention is the stock’s valuation at the time of purchase. Buffett shelled out a forward P/E multiple of 24, which qualifies as aggressive by his historically conservative standards. Nevertheless, this move reaffirms his philosophy of patiently awaiting opportunities where quality intersects with reasonable pricing—a patience he has exemplified throughout his career, even amid periods of substantial cash accumulation on Berkshire’s balance sheet.

Broader Implications for Investors Watching Buffett’s Moves

Buffett’s final quarter actions offer valuable lessons for investors navigating today’s market environment. The aggressive trimming of high-flying names like Amazon, Apple, and Bank of America serves as a reminder that even the most exceptional businesses can become poor investments when purchased at excessive prices. Conversely, the initiation of a meaningful position in The New York Times illustrates the enduring appeal of established brands adapting successfully to digital transformation.

As Berkshire transitions into a new leadership era, Buffett’s parting portfolio maneuvers encapsulate decades of wisdom: prioritize intrinsic value, maintain liquidity during periods of overvaluation, and pounce on quality when margins of safety emerge. For those tracking the Sage of Omaha’s decisions, this 13F filing provides a fitting capstone to an unparalleled investing legacy.