AVAV: 30% Drop Makes Drone Leader a Strong Buy Opportunity

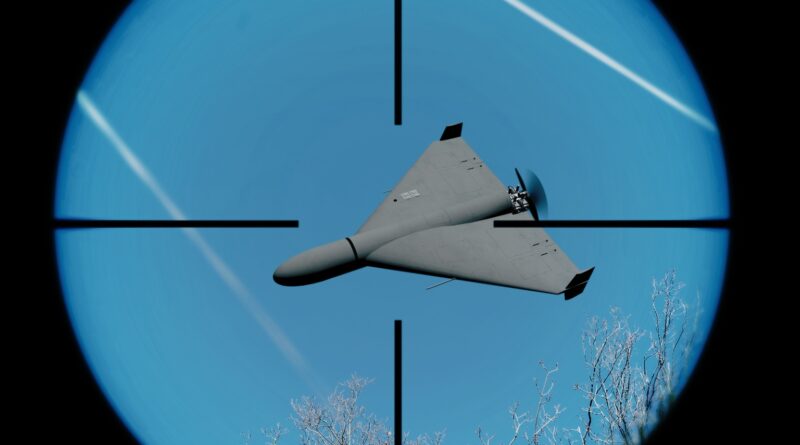

AeroVironment, a prominent player in the drone technology sector, has experienced a substantial 30% decline in its share price since the previous assessment that highlighted concerns over an elevated valuation. This correction has now positioned the stock as an attractive investment opportunity with significant potential for appreciation. The recent operational deployment of the company’s LOCUST counter-drone system by the US Army near El Paso Airport serves as a key validation of AeroVironment’s strategic acquisition of BlueHalo. This move not only bolsters the firm’s capabilities but also solidifies its competitive edge within the rapidly expanding field of defense technologies focused on unmanned systems.

Despite a history of inconsistent earnings per share performance, AeroVironment is poised for robust growth in both revenue and free cash flow, particularly as the integration of BlueHalo progresses effectively. Analysts project a price target of $324.27 by 2028, which suggests an impressive 33% upside from current levels. Furthermore, the company’s strong net cash position alleviates much of the financial strain associated with funding acquisitions, providing a solid foundation for future expansions and operational enhancements.

The successful fielding of the LOCUST system underscores the practical value of the BlueHalo acquisition, demonstrating AeroVironment’s ability to deliver cutting-edge solutions for modern defense challenges, such as countering adversarial drone threats. This development enhances investor confidence in the company’s technological prowess and market positioning. Looking ahead, the anticipated revenue acceleration stems from increasing demand for unmanned aerial systems in military applications, coupled with the synergies unlocked through the recent merger.

AeroVironment’s financial health, characterized by its ample cash reserves, positions it well to pursue additional growth initiatives without excessive reliance on external financing. This financial flexibility is a critical factor in sustaining long-term competitiveness in the high-stakes drone and defense tech arenas. The upgrade from hold to buy reflects a reassessment of the stock’s valuation in light of these positive developments and the compelling entry point created by the recent selloff.

In summary, the 30% share price drop has transformed AeroVironment into a compelling buy for investors seeking exposure to the burgeoning drone defense market. With validated technology, improving financial metrics, and a clear path to substantial upside, the company stands out as a leader ready to capitalize on evolving geopolitical and technological trends.