Ark Invest’s Forecast Signals Challenges for Rigetti Quantum Stock

Rigetti Computing Faces Headwinds from Ark Invest’s Quantum Outlook

In 2025, investors showed tremendous enthusiasm for quantum computing stocks, driving significant price surges. However, many of these investments have experienced sharp declines in recent times, prompting a reevaluation of their prospects.

Classical computing technology has advanced remarkably over the decades, yet it remains constrained by fundamental limitations. Even the most sophisticated processors can only execute a finite number of computations simultaneously. This bottleneck explains why artificial intelligence firms are constructing massive data centers packed with countless chips to boost their processing capabilities. Greater chip counts translate directly to enhanced computational power.

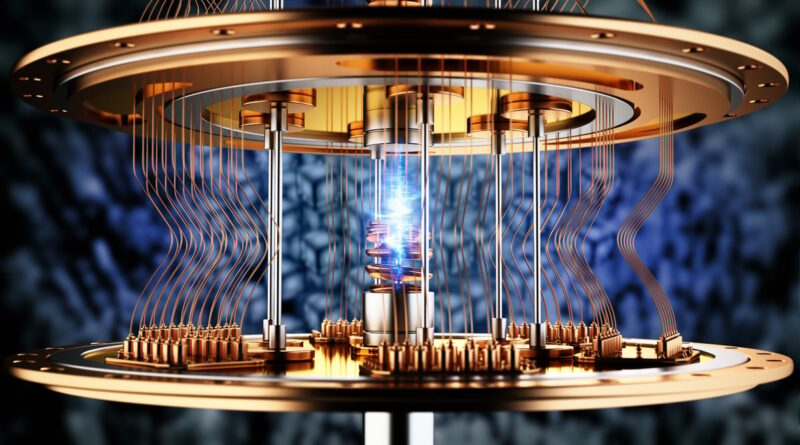

Quantum systems, such as those pioneered by Rigetti Computing, leverage the principle of superposition. This allows them to explore multiple potential solutions to complex problems concurrently, potentially outpacing even the largest supercomputing facilities in specific tasks. Theoretically, quantum computers hold the promise of revolutionary advancements in fields including scientific research, materials discovery, and cryptographic protocols, opening up vast economic opportunities for innovative players like Rigetti in this emerging sector.

Ark Investment Management, led by the renowned technology investor Cathie Wood, annually publishes its influential Big Ideas report. This comprehensive document analyzes the landscape of technological innovation, pinpointing both potential rewards and inherent risks across various domains. The 2026 edition includes provocative assertions that challenge the timeline for quantum computing’s practical deployment, implying it may be far more distant than current market optimism suggests.

An Early Pioneer in the Quantum Computing Arena

To contextualize Ark’s projections, it is essential to examine Rigetti Computing’s position within the quantum landscape. The company has emerged as a frontrunner, distinguishing itself through vertical integration. Unlike many peers that outsource critical components, Rigetti operates its own fabrication facility. It has also developed a proprietary programming language named Quil and launched a cloud-based platform that provides on-demand access to quantum processing power for enterprise clients, generating revenue through usage fees.

This end-to-end control over hardware and software production enables Rigetti to iterate and deploy improvements at a pace unmatched by competitors reliant on external suppliers. A prime example is the Cepheus-1-36Q, recognized as the largest multichip quantum processor in the industry, boasting an impressive fidelity rate of 99.5 percent.

Conventional computers rely on bits that exist definitively as either 0 or 1, making them straightforward to measure and manipulate. In contrast, quantum computers employ qubits capable of embodying both states simultaneously through superposition. This unique property empowers them to rapidly model intricate datasets and simulate outcomes that would overwhelm traditional systems. Fidelity quantifies the precision of individual quantum operations; elevated fidelity signifies reduced error occurrences, rendering the system more viable for practical, real-world applications.

Despite these strides, a 99.5 percent fidelity level equates to an error approximately every 200 operations, which remains insufficient for the majority of commercial scenarios. Consequently, Rigetti’s revenue streams are still modest. The company anticipates releasing its complete 2025 financials next month, but for the first nine months ending September 30, it recorded only $5.2 million in sales—a negligible figure relative to its $5 billion market capitalization.

Looking ahead optimistically, Rigetti has outlined ambitious roadmaps: a 150-qubit system achieving 99.7 percent fidelity by late 2026, scaling to a 1,000-qubit machine with 99.8 percent fidelity in 2027. These enhancements are poised to stimulate greater enterprise adoption and revenue growth.

Ark’s Projections Raise Alarms for Quantum Enthusiasts

Alphabet, the conglomerate behind Google, is aggressively pursuing quantum supremacy with resources dwarfing those of nimble startups like Rigetti. As a $3.7 trillion behemoth, Alphabet’s quantum efforts benefit from unparalleled funding and talent pools.

Drawing from extensive research, Ark posits that Alphabet’s quantum hardware doubles its qubit count and slashes error rates by 40 percent roughly every four years. Under this trajectory, these systems would not attain the capability to breach the RSA-2048 encryption standard—a cornerstone safeguarding most online transactions—until 2063. Disruptive such a feat would be, fundamentally reshaping global cybersecurity paradigms.

The RSA algorithm theorizes that a quantum machine with 20 million qubits could decrypt it in merely eight hours. Yet, contemporary quantum prototypes operate for mere milliseconds before decohering, underscoring the chasm between laboratory feats and scalable utility.

Ark entertains a more accelerated scenario: if qubit growth and error mitigation double every two years, cryptographic utility might emerge by 2044. Notably, Rigetti’s planned leap from 2026 to 2027—nearly septupling qubits while trimming errors by about 33 percent—aligns with aggressive optimism. Nevertheless, quantum scaling obeys exponential difficulty curves; sustaining such velocity indefinitely proves elusive as systems grow larger.

Rigetti’s Premium Valuation Poses Substantial Risks

Rigetti’s shares have plummeted 71 percent from peak levels, yet they boast a staggering 1,550 percent three-year gain. This volatility reflects speculative fervor, but with revenues in the low millions against a $5 billion valuation, sustainability appears tenuous.

Trading at a price-to-sales multiple of 617, Rigetti eclipses even high-flying peers. By comparison, Nvidia, the AI computing titan, commands a P/S of 24. Such disparity highlights Rigetti’s frothy pricing amid nascent commercialization.

Given Ark’s timeline suggesting decades before quantum achieves commercial viability with tolerable error profiles, Rigetti’s path to revenue justification stretches long. Investors should brace for potential further erosion in share value as market realities temper expectations.

Strategic Considerations for Rigetti Computing Investors

Quantum computing represents a paradigm shift with transformative potential across industries, from drug discovery to optimization challenges intractable for classical means. Yet, as a pre-revenue innovator, Rigetti exemplifies the high-risk, high-reward profile inherent to frontier technologies.

Cathie Wood’s Ark Invest underscores a sobering reality: technological maturation lags investor timelines. Rigetti’s in-house fab, Quil ecosystem, and cloud services position it advantageously, but error correction remains the pivotal barrier. Upcoming qubit expansions could catalyze partnerships and contracts, yet commercialization horizons extend years, if not decades.

For those eyeing exposure, diversification tempers volatility. Rigetti’s leadership in fidelity metrics merits monitoring, particularly post-2025 earnings. However, with valuations unanchored by profits, prudent positioning favors patience over pursuit of momentum plays.

In summary, while Rigetti advances the quantum frontier, Ark’s forecast tempers near-term exuberance, signaling a marathon rather than sprint to viability. Investors must weigh speculative allure against protracted development risks.