Alphabet Stock: Top Contender in Robotaxi Revolution

Waymo is ready to grow fast

The autonomous driving landscape is rapidly evolving across multiple urban centers in the United States, where one prominent player is establishing itself as the frontrunner. Waymo, a wholly-owned subsidiary of Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), stands out prominently in this competitive arena. While it is true that Tesla (NASDAQ: TSLA) is also advancing its autonomous vehicle capabilities, Waymo has secured a substantial advantage by deploying fully operational self-driving robotaxis on public roads well ahead of its rivals.

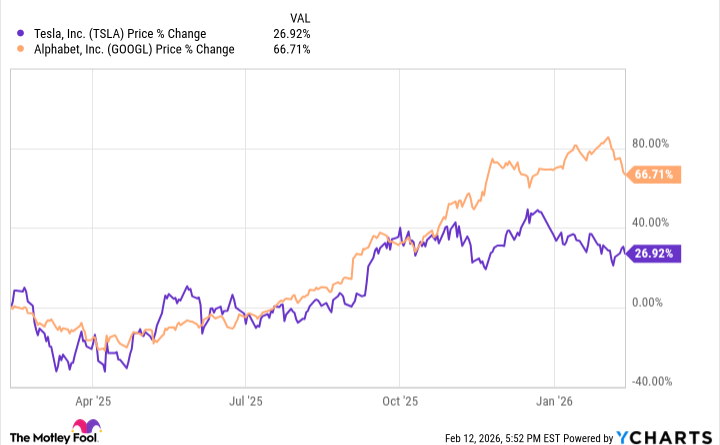

This pioneering position in the robotaxi sector may not be the sole driver of Alphabet’s impressive stock performance, but it certainly contributes significantly. Over the past twelve months, shares of Alphabet have notably surpassed those of Tesla in terms of returns, highlighting the market’s growing confidence in Waymo’s trajectory and its potential impact on the parent company’s valuation.

Several compelling factors position Alphabet’s stock as a prime beneficiary in the emerging robotaxi market. Foremost among these is Waymo’s aggressive expansion strategy. In a detailed discussion with Bloomberg, Waymo’s co-Chief Executive Officer, Tekedra Mawakana, outlined ambitious projections for the company’s growth. By the close of 2026, Waymo anticipates delivering over 1 million paid autonomous rides each week throughout the United States. This target represents a remarkable 150% surge from its existing weekly volume of approximately 400,000 rides, underscoring the scalability and demand for its services.

Currently, Waymo’s fleet operates seamlessly in six major American cities, such as Los Angeles, Atlanta, and Phoenix. These locations have proven to be fertile ground for testing and refining autonomous operations under diverse real-world conditions. Looking ahead, the company has announced plans to extend its ride-hailing services to an additional 20 cities during the current year. This expansion will include international destinations like London and Tokyo, marking a bold step toward global proliferation of robotaxi technology.

Such rapid scaling not only demonstrates Waymo’s operational maturity but also its capacity to capture a dominant market share in the burgeoning autonomous mobility sector. As urban populations increasingly seek convenient, efficient transportation alternatives, Waymo’s infrastructure positions it to meet this rising demand head-on.

Waymo might have a technological edge

Further bolstering its competitive standing, Waymo recently introduced its sixth-generation Waymo Driver system on February 12. This cutting-edge hardware and software suite promises substantial enhancements in the vehicles’ environmental perception and navigation prowess. Key upgrades include a state-of-the-art high-resolution sensor boasting 17-megapixel imaging capabilities, coupled with the latest sixth-generation LiDAR technology for precise light detection and ranging measurements.

These advancements are designed to elevate the robotaxis’ performance across challenging conditions, particularly in adverse weather like heavy rain or snowfall, where visibility and sensor accuracy are paramount. Moreover, the new Waymo Driver architecture facilitates significant cost reductions in operations, allowing the company to offer more affordable rides while maintaining superior safety standards.

Complementing these technological leaps, Waymo is ramping up vehicle manufacturing at its dedicated facility in Phoenix, Arizona. Production targets aim for tens of thousands of fully autonomous vehicles annually, ensuring a steady supply to support nationwide and international rollout. This manufacturing scale-up is crucial for sustaining growth momentum and meeting the anticipated surge in ride demand.

In contrast, Tesla’s Full Self-Driving (FSD) software, while innovative, has yet to achieve the same level of deployment for unsupervised passenger services. Tesla’s robotaxi initiative remains limited primarily to Austin, Texas, where operations still incorporate human safety drivers for oversight. Additionally, its California-based ride-hailing involves human-operated vehicles, falling short of Waymo’s fully driverless model.

The autonomous driving industry remains in its nascent phase, with uncertainties surrounding the long-term profitability of robotaxi fleets and their precise contribution to corporate earnings. Nevertheless, Waymo’s current dominance in operational robotaxis during 2026 positions it as the frontrunner. For investors eyeing exposure to the transformative potential of autonomous transportation, Alphabet stock emerges as the most direct and compelling avenue.

Key Data Points for Alphabet

Alphabet’s financial profile underscores its robustness as an investment in this space. With a market capitalization exceeding $3.7 trillion, the company commands immense scale across its diverse portfolio, including search, cloud computing, and now autonomous vehicles. Recent trading saw shares fluctuate between $296.26 and $304.38, closing at $301.92 after a modest daily decline of 1.24% or $3.80.

- Market Cap: $3.7T

- Day’s Range: $296.26 – $304.38

- 52-Week Range: $140.53 – $349.00

- Volume: 1.8M

- Average Volume: 38M

- Gross Margin: 59.68%

- Dividend Yield: 0.27%

These metrics reflect Alphabet’s financial health and market liquidity, providing a stable foundation for Waymo’s ambitious pursuits. The high gross margins indicate efficient operations, while the dividend yield offers modest income alongside growth prospects.

As the robotaxi market matures, Waymo’s lead could translate into substantial revenue streams for Alphabet, potentially driving further stock appreciation. Investors should weigh these developments against broader market dynamics, but the company’s technological and operational advantages make a strong case for inclusion in diversified portfolios focused on future mobility innovations.